9-11 Portfolio

- By : Menard

- Category : Asset allocation, Investing

The week ending 9-11 was somewhat catastrophic as global equities and emerging-markets tumbled by at least 2%. Dow Jones index was down by 394 points, while the S&P 500 fell by 53 points. It was the biggest rout since Britain voted to secede from the European Union. The previous two months have been very tranquil in comparison.

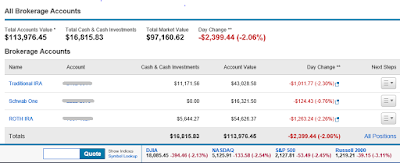

That said, my brokerage portfolio lost $2,399.44 in just one day…

Roughly 70% of our assets are invested in mutual funds and a few individual stocks. 85% of this portfolio is invested in highly diversified stock mutual funds. Only 9.6% of this is invested in bonds, and the rest are parked in cash.

It’s probably worth mentioning that a small percentage of the International Equity portion is invested in the Philippines, my country of origin. EPHE is an emerging market ETF (exchange-traded fund) that tracks the country’s market. It is composed of great companies that I’ve known since I was a kid (Ayala, SM, PLDT, etc.).

The Philippine stock market took a hit when President Obama canceled a meeting with the country’s new president, Rodrigo Duterte after the latter called him a “son of a whore.”

Note that I’m refraining from making political comments about the new president in an effort not to make this a political blog.

I’d be lying not to admit that I’m somewhat disappointed that our overall portfolio took a hit by around $12,000 or half a million pesos in just one day. But it was only because it was on the brink of reaching the one million dollars mark. The first million is indeed the hardest.

In the past, I’ve always anticipated buying opportunities. Everyone knows what happened in 2008 when the markets tumbled, tumbled, and tumbled even more due to the housing crisis and credit default swap fiasco. While everyone that I asked, sold, sold and sold more; I bought, bought, and bought more.

Our net worth had quadrupled since then. So trust me, I’m always on a lookout for buying opportunities.

Update 10/30/2019: I sold all my holdings in Emerging Markets (China and the Philippines), absorbing a small loss, and bought additional Microsoft stocks instead. Good riddance!

No Comments