I'm flattered to admit that I never had chance to get/use a credit card at

age 50+….

If you have a low credit score, you might as well forget about buying anything on credit. Interest rates are so much higher now compared to when I first published this post. Instead, I’d focus on repairing my credit as I did, which is what this post is all about.

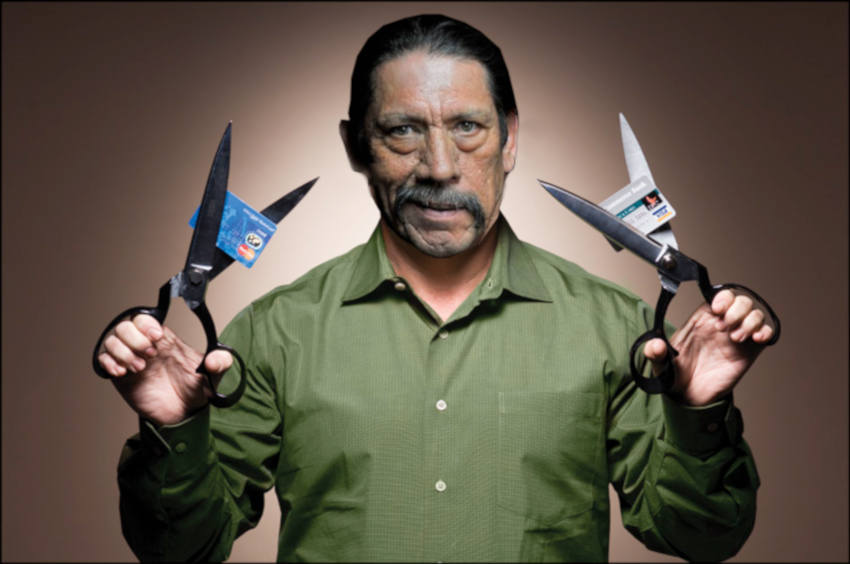

You’ve probably heard this line a hundred times at the cash register before, “Would you like to apply for a store credit card? You’ll save 10 percent on today’s purchase.”

That was the offer that I accepted from a BestBuy store clerk sometime in the late 90s, not long after I started working here in the States. I came out of the store smiling; it was the first time I’d ever bought something without having to shell out cash.

I probably saved about $4 as the purchase was less than 50 bucks. But since the item was not of significant value, I totally forgot about the purchase; more so, paying the credit card bill. It was a bizarre case of amnesia, reminiscent of Jason Bourne but minus the fast-paced action and bone-breaking stunts.

What turned out to be thrilling was the part where I eye-balled my credit report, one year later. By then, it was too late. My FICO score plummeted to the 500-600 range, which was poor by any standard— all due to that single transaction.

Fortunately, I wasn’t really in need of any loan at the time. I already took out a loan for my car and was years away from buying a house. Otherwise, I would have been hit by significantly higher than-average interest rates that could have amounted to tens of thousands of dollars.

I was young, fresh off the boat, and stupid.

If you’re a 20-something millionaire-wanna-be who wants to avoid the costly mistakes that I’ve made about money; give your future self a favor— subscribe to this blog by entering your email below.

Thank goodness, we have FICO scores

FICO stands for Fair Isaac Corporation– the company that buddies Bill Fair and Earl Isaac founded in 1956. Now, it is the most widely accepted measure of creditworthiness.

The score range from 300 to 850. A score of 760 or higher usually gets you the best deal on interest rates. Conversely, a lower score will make it harder for you to get a loan, land a job or qualify for the best terms on a wide variety of consumer contracts.

American creditors and consumers have no idea how lucky (or unlucky) they are that they have no less than three credit bureaus keeping a tally of credit scores: TransUnion, Equifax, and Experian. Each of these agencies is required by law to provide consumers with a free copy of their credit report at least once a year.

Where I grew up, credit investigations go something like this. First, you apply for a loan in person at a local bank. The next day, the bank sends a 6′ tall hulking guy with 17″ arms (intimidating by Filipino standards) in a motorcycle to your neighborhood. He knocks on your door, all smiles, so you don’t have any choice but to send him in. You engage in small talk, as he scans the surroundings of your home for potential collateral targets (ala Ah’nold ‘The Terminator’ style).

If you don’t happen to be there that day, he’ll talk to your next-door neighbor. The next thing you know, everybody in the neighborhood knows that you’re trying to finance a brand-new Toyota Corolla.

Here in the U.S., having a decent FICO score is very important for young people who are just starting out. More and more companies are checking for your credit score when you apply for a job or look for a place to rent, for example.

What affects your credit score

According to Equifax, here are the factors that affect your scores. Some will affect your score much seriously than others.

High impact

Credit Card Usage shows how much you spend on your credit cards as a percentage of your total available balances (your credit limits) for all of your credit cards. A high percentage could indicate that you don’t have your spending under control and could be at a greater risk of defaulting on your payments. Try to keep your credit card usage under 30%.

Payment History plays a critical part in determining your score. Making your payments on time shows potential lenders how reliable you are in paying back what you owe. Be sure to make all of your payments on time (even if it’s just the minimum payment due), and remember that other types of credit payments such as those for student loans and auto loans affect your score.

Derogatory Marks are indications of poor behavior in the past when it comes to being responsible for credit. These include accounts in collection, liens, and bankruptcies—things potential creditors are definitely wary about. Sometimes things like this happen and they’re beyond your control but if you can, by all means, do your best to keep these things from happening. No matter the reason, these negative marks will likely stay on your credit report for seven years or more.

Medium impact

Age of Credit is the average amount of time you’ve had all of your open credit accounts. It measures the longevity of your credit history. Opening several accounts in a short period of time may indicate a great level of risk, so avoid opening lots of credit accounts unless you really need them. Be sure, also, to keep your old accounts open with good payment history for each.

Low impact

Total Accounts is the number of accounts you have, which may be an indicator of how creditworthy lenders think you are. Don’t go crazy and open a lot of accounts, though, because the average age of credit is more significant than the number of accounts when calculating your credit score.

Credit Inquiries is a count of all hard credit inquiries placed on your credit report. What makes an inquiry “hard” is when you authorize a lender to get your credit report for their benefit so they can evaluate you when you apply for a credit card, a loan, or other forms of credit. If you get your credit report yourself or go through an agent such as Turbo to get it for you on your behalf, it’s called a soft inquiry and it does not affect your credit score.

How I repaired my credit

First, I contacted the collection agency in the report and paid off the balance. I wish I could dispute it, but I really owed the money. I had to pay Caesar what is due to Caesar. That’s what my bible tells me.

Secondly, I took out a secured credit card with First Premier Bank. With secured credit cards, I had to put up a $500 security deposit in order to open an account. The amount served as collateral for my credit limit. I used the card regularly and paid it off in full. I used it solely for my gasoline purchases because the cost is very predictable. In this way, the credit is not fully utilized.

Once my credit improved, I applied for a real credit card— it was a Bank of America credit card with no annual fee. I’ve been using the same card ever since.

Five years later, I opened two additional cards. It was with American Express and Chase. I used both regularly but I never exceeded more than 30% of the limit.

I paid my bills on time. I paid my bills in full every time.

Now, I have exceptional credit scores. The results can speak for themselves.