Life Without Retirement Savings Sucks (and what you can do about it)

- By : Menard

- Category : Retirement

- Tags: No Retirement Savings, Working Until You Die

Once upon a time, people did not retire. They just worked, worked, and worked some more until they could no longer work. Saving for retirement was not a thing because people died from sickness or diseases before their knees gave in— Penicillin was yet to be discovered, and vaccines were non-existent.

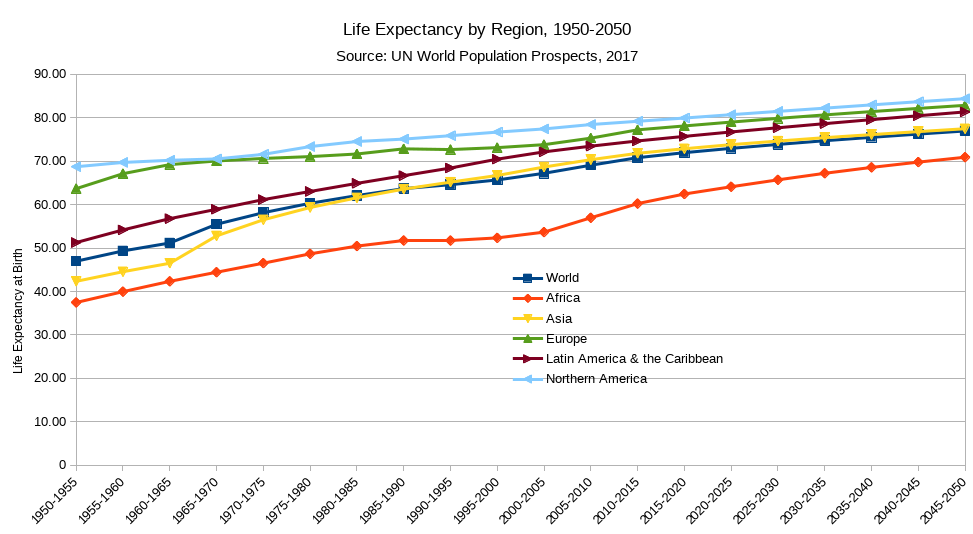

Fast forward to 2020, thanks to advancements in medicine, many people can live well into their ’80s and ’90s, and yet a disturbing amount of Americans are still not saving for retirement.

Sure, the coronavirus pandemic can change all this. But still, no less than 23 companies joined the race to develop a vaccine; I’m confident that we’ll soon have one. So, dying early from the virus is not a sustainable retirement plan.

This begs the question: What does life without retirement savings look like?

You need to keep working until you die

For many seniors, the answer to this lack of savings is obvious: working until you can no longer work. No different from what past generations of people were doing, right?

Except that continuing to work past the age of 65 may not be an option. You may live a longer life, but memory loss, inability to drive, or a debilitating illness, among others, can all hinder you from working.

And then there’s ageism. Even people in their ’50s can be vulnerable. You can end up discriminated during job searches for being too old.

Take, for example, a job applicant named Philip, who has an impressive, albeit “long in the tooth,” resume in LinkedIn:

“The headhunter actually told me that the client said I was too old for the job. I asked him if that was illegal – I’m pretty sure it is – and he said that the client’s view is that if they don’t interview me, I’m not a candidate, so it’s not discrimination.”

Whether that’s illegal or not, let’s face it. The older you are, the tougher it will be to compete with younger applicants. It’s dangerous to assume you can always find a job when you’re past your prime.

Don’t live in a fantasy like the following E-Trade commercial humorously portrays:

You’re forced to take odd jobs to make ends meet

Having sufficient money in retirement gives you options. One of them is not having to take a menial job to put food on the table.

Of course, there’s nothing wrong with taking odd jobs you love. My first ever job was serving hamburgers at a very popular Filipino hamburger franchise that competes with McDonald’s.

I didn’t need the money— I was 17, still living with my parents, who gave me a generous daily allowance. I loved going to work anyway because the prettiest girls work in the joint. It was obvious the company only hires young people. Back in the day, discrimination of all types was rampant. The less good-looking ones worked in the kitchen, for example.

Many years ago, I remember seeing my 80-something widowed neighbor work at a nearby Burger King. We sent her flowers when her husband died a few months earlier. I can only speculate she ran out of money due to her husband’s medical care.

Women live longer, which makes them especially vulnerable during retirement. They outlive their husbands, sometimes by a margin of 10 years, and once alone, often can no longer pay the bills, typically losing a substantial part of their household’s Social Security income.

You sell your home to fund your retirement

Imagine selling the house you’ve lived in for decades, along with many of your personal belongings, to live in a small apartment away from your family and friends.

That’s what happens if you neglect to save for retirement in favor of funding a house that you cannot afford.

An alternative is to get a reverse mortgage where you receive payments from the bank. It’s likely saddled with high fees and interest rates — you’ll die owing more than your home is worth. That is if you have a paid-off (or significantly paid-down) home.

Either way, you leave no property to your heirs that they can enjoy.

It’s even worse if you don’t have substantial equity in your house. A couple I know purchased their house with almost nothing down in 2000. Twenty years later, they still haven’t paid off their mortgage— refinancing to another 30-year mortgage instead— to be able to fund the kids’ college.

It’s very likely they’d end up spending double the market value of the house in interest payments alone. That’s money they could have used to fund their “golden years.”

They are already in their ’50s, and the husband is not insurable because of health issues. Unless they aggressively pay down their mortgage, they’d be in their ’80s and still making payments.

I can smell a financial disaster a mile away.

You drown in debt and move in with the kids

Not long ago, we visited a couple dear to us, who have fallen to hard times. The husband had been diagnosed with lung cancer and was undergoing treatment.

They’ve lost their house to foreclosure, cars to repossession, and filed for bankruptcy. And as it turns out, the apartment was rented by one of their kids.

“Social Security is barely enough to cover our needs. We are still on the hook for $300,000 in student loan debt we took for the kids. Two of them still don’t have a steady job to help pay for it,” the wife confessed.

You generally can’t discharge student loans in bankruptcy. The standard for a student loan hardship discharge is very high. You can show up in court with an amputated right arm and still get denied because you have your left intact.

Parents, please never co-sign student loans for your kids.

Final thoughts

Living longer is certainly a blessing. But being a 90-year-old with no money is not a particularly good problem to have. Your standard of living diminishes, and you become a huge burden to your kids, who already have responsibilities of their own.

“If I knew I was going to live this long, I would have saved more for retirement!” is a common regret among many retirees. Don’t be one of them.

Here’s what you can do:

- Live below your means. Don’t spend more than 1/4 of your income on housing costs. Owning a fancy new car with leather seats when you’re still making payments is absolutely ridiculous. Don’t borrow to pay for a wedding or a university that you can’t afford.

- Create a budget. Don’t waste your money on frivolous stuff like a pack of cigarettes or a double mocha cappuccino— small leaks in your budget can sink a ship!

- Pay off consumer debts. Start by paying down the ugliest debt first. No monthly payments mean you have more money to invest. Get rid of your credit cards if they cause you to misbehave.

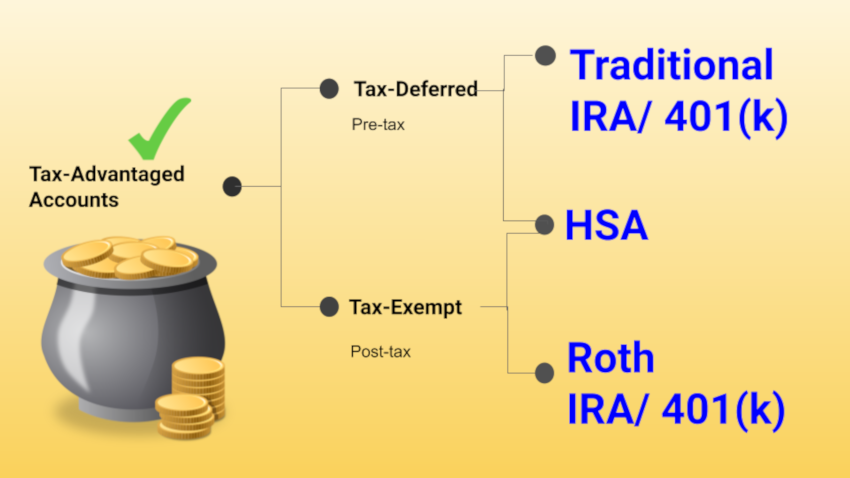

- Maximize your retirement contributions. Beef up your 401(k), IRA, and other tax advantage accounts. Make catch-up contributions if you’re 50 and over. Invest in broad-based, low-cost stock index funds like the ones offered by Vanguard (e.g., VOO, VTSAX, VTI).

And for goodness sake, invest now, while time is on your side!

No Comments