The Shortest Path to Wealth is Not Necessarily the Best Route to Take

- By : Menard

- Category : Books, Financial Planning

What is the shortest path to wealth? Frankly, I have three words for you: “Marry for money.” Either that or “Win the lottery.” Neither is realistic nor practical unless you happen to be extremely attractive or incredibly lucky.

If you ask a few personal finance gurus, however, you’ll get differing views and perspectives.

“Leverage other people’s money.”

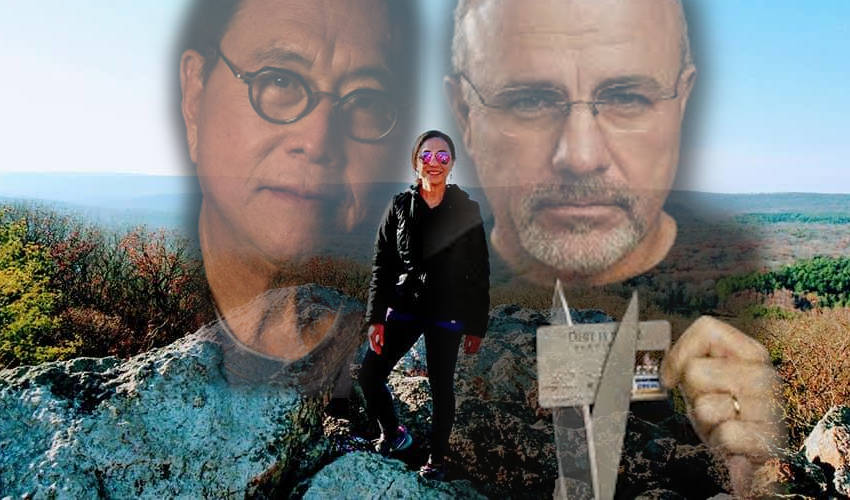

Robert Kiyosaki, finance guru and author of the best-selling book Rich Dad Poor Dad, loves to talk about the concept of using “other people’s money” or OPM.

“There are two ways to get rich. One way is to use your own money. The other way is to use other people’s money, or as we call it at Rich Dad, OPM,” Kiyosaki writes on his blog.

“One provides small-to-modest returns, takes a long time to pan out, and requires some financial intelligence. The other (OPM) provides large-to-infinite returns, creates incredible velocity of money, and requires a high financial intelligence.”

Kiyosaki was obviously referring to entrepreneurship through debt or equity financing as the faster route.

It’s hard to disagree with Kiyosaki. After all, many successful companies were built using OPM. Founders of Big Tech companies, like Amazon and Netflix, initially used their own money to fund growth but eventually sought other people’s money through borrowing, government grants, angel investors, or IPO.

What Kiyosaki failed to mention, however, is the risk. Leverage is like a double-edged sword. Debt requires repayment with interest. If the debt isn’t repaid in a timely manner, the debt holders can force the company into bankruptcy.

Equity financing, while not the same as debt, is less risky. But owners would have to give up more ownership, reducing their share of future profits and decision-making power.

According to this Forbes article, 8 out of 10 businesses fail within the first 18 months. So, suggesting that the quickest route to wealth is by leveraging other people’s money to invest in real estate or start a business is telling just half of the story. You are more likely to lose your shirt than become wealthy.

“The shortest distance to wealth is not through debt.”

Debt-hating guru, Dave Ramsey, offers the following opposing view:

“The quickest way to build wealth is to get control of your largest wealth-building tool – your income. When all your money goes out the door to other people, you don’t have that tool at your disposal when it comes to important things like saving and investing. Getting out of debt dramatically shortens the distance between you and wealth.”

I can understand Ramsey’s risk-averse view of money. At the age of 26, Dave Ramsey was bringing home a quarter of a million dollars a year and had a $4 million real estate portfolio fueled by debt. He lost everything two years later and filed for bankruptcy after banks demanded repayment. He’s learned his lesson since then.

Today, he’s built a successful company without taking on debt. I had the privilege of meeting Dave at his new Ramsey Solution headquarters in Nashville, TN, and was quite impressed with what he has accomplished. The beautiful building sits on 47 acres, and the site development costs at least $70 million. All paid in cash!

However, what he was referring to is the “slow and steady” approach to building wealth. I’ve written about that myself in this blog as the best way for most people. Many millionaires have done just that with great success. But to say that it’s the shortest distance is simply not true.

The problem is, he didn’t make a distinction between consumer and investment debt. The lucky ones who took out a mortgage in places like San Francisco and New York City in the ’90s must have benefitted immensely from the capital appreciation. Same with high-earners who invested in themselves through reasonable loans to get advanced degrees.

The opportunity might not have presented itself at the right time had they not taken any risk. Not everyone who uses good investment debt would necessarily have the same experience as Ramsey did. He seemed to forget one of the basic tenets of investing: the greater the risk, the higher the reward!

That leads me to my point in writing this article:

The shortest path depends on your capability and appetite for risk.

In the book Rich Habits, best-selling author Tim Corley details five years of observing and documenting the daily activities of 233 wealthy individuals (all had at least $160,000 in annual gross income and $3.2 million in net assets), he found that there are four main paths to becoming a multimillionaire:

- The Saver-Investors path: Grew their wealth through regular saving and investing

- The Company Climbers path: Climbed the corporate ladder and ended up with an extremely high salary (e.g., CEOs and other top executives)

- The Virtuosos path: Have been paid a high premium for their knowledge and expertise (e.g., medical specialists, BigLaw attorneys)

- The Dreamers path: Started their own business and their passion shows up in their bank accounts

Among the four, the “Savers-Investors” path is the easiest, while the other three involve much more risk. The Dreamers path is the fastest way to get rich if you have what it takes.

But there is no absolute shortest path. It all depends on your personality and traits. Not everyone has the capability nor the risk tolerance to become an entrepreneur or a landlord. Everyone is different.

A good analogy is a hiking trip that my family and I recently went to. Near the pinnacle of the hike, we saw a red sign that says “very strenuous” and another that says “moderate.” I’m glad they took the easier route. The first was shorter, but it would have been impossible for my kids to rock climb a huge boulder with a 60 degree incline.

The shorter path is not always the best route to take.

No Comments