updated:

Her pension is worth 1/2m. (1,753 x 12mths) X 25(4% rule) = +1/2 million

Net Worth Update: Six Years Later

- By : Menard

- Category : Financial Planning

Once again, it’s Labor Day– the day I “brag” about the fruits of my labor. Except there’s nothing to brag about this year. Our investments have been hammered like cryogenically frozen horse meat you badly want to barbecue.

As a result, our household net worth is down for the first time in the six years I’ve been publishing our numbers. But that’s not necessarily a bad thing. I’ll explain later in this post why.

Ladies and gentlemen, here are our latest numbers…

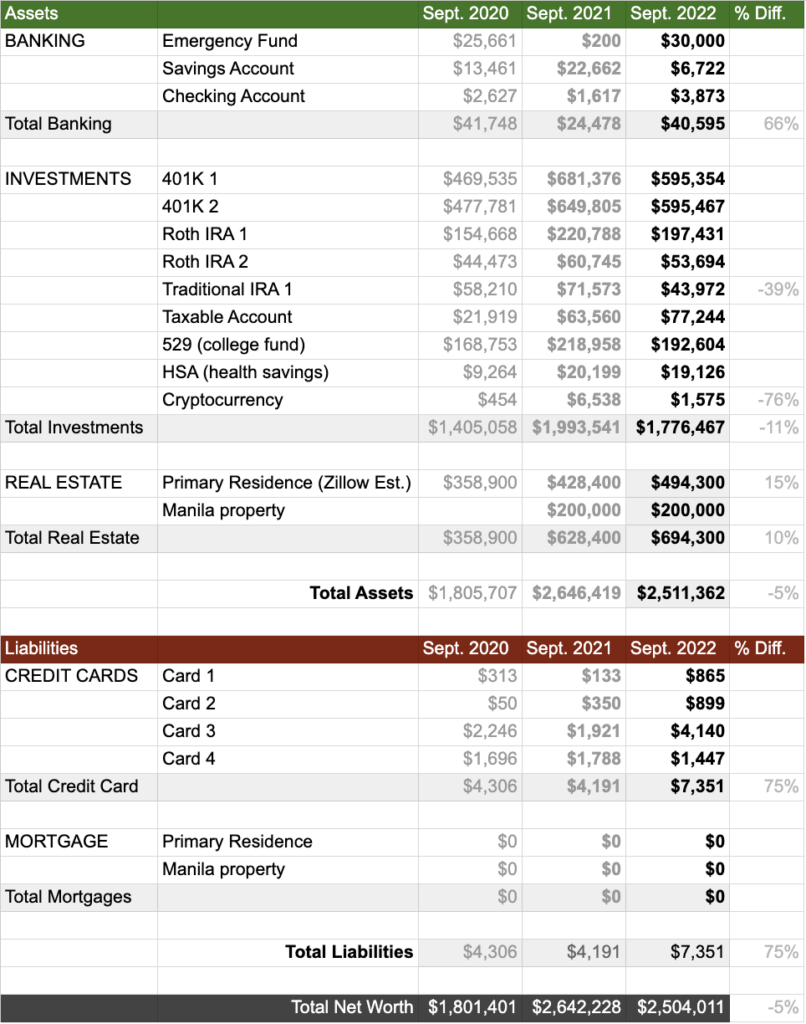

Assets are down by 5%

It has been a painful year for people investing in the markets. Nearly every asset class plummeted due to record-high inflation, the energy, food, and supply-chain crisis brought about by the pandemic, and the Fed’s quantitative tightening of the markets. Not to mention the “special military operation” waged by asshole Putin.

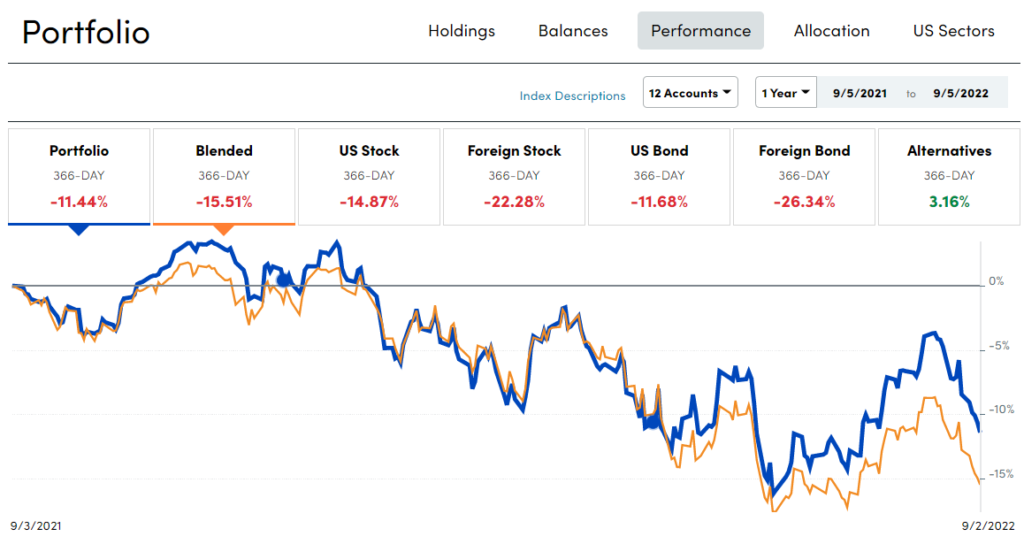

In particular, our investment portfolio is down 11% compared to last year despite the contributions. The bright side is our blended portfolio mix of roughly 85/15 ratio of stock and bonds (blue line) substantially beat Personal Capital’s mix with a similar ratio (orange line):

Switching to short-term inflation-protected securities helped. When interest rates rise as what the Fed is doing now, the prices of bonds fall. The longer the maturity, the harder they fall. So it made sense to switch to short-term bonds. I’m glad I switched the bond portion of our 401(K)s to Vanguard Short-Term Inflation-Protected Securities Index (VTAPX) and Fidelity Inflation-Protected Bond Index (FIPDX) last year to mitigate inflation and interest rate risk.

Our home value has increased 15% from last year albeit at a slower phase. That’s according to the latest Zillow valuation. The housing market is slowing down because it’s becoming harder for buyers and renters to afford housing with steep mortgage rates and ultra-high prices.

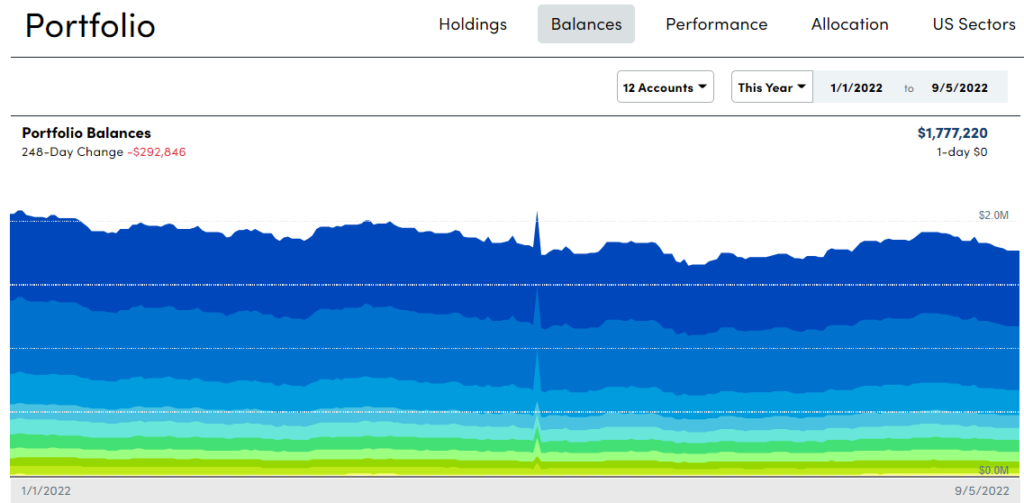

In sharp contrast to last year, our investments had been volatile, went below the $2M mark, and stayed there for most of the year.

Liabilities are up by 75%

With no home or car mortgages, to begin with, we don’t have much debt. Having $7K of debt is like owing someone $7 when you have $2,500 in your wallet. It’s no big deal, we’ll pay it off as soon as this post is published. Rest assured, we hate debt so much we pay it off in full regardless of the interest rate.

The only reason why our credit card balances grew that much is we just came back from a vacation in the Philippines where we splurged on restaurants and fancy hotel rooms.

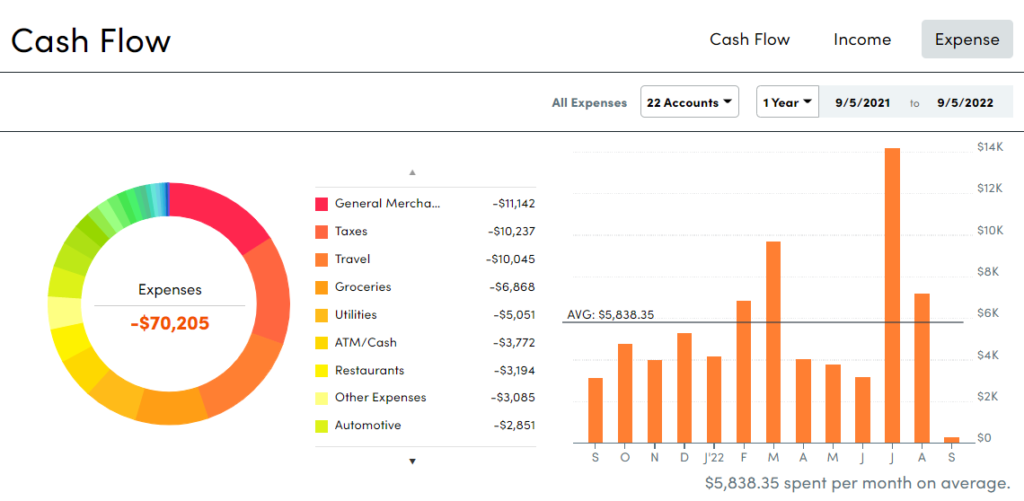

Still, we’ve spent $4,000 less in the past 365 days compared to the same period last year:

Net worth statement for 2022

(i.e., Total assets minus total liabilities)

For 2022, we’ve substantially built up our emergency fund to $30K just in case we need to buy a “new to us” car.

Lastly, my experimental cryptocurrency investment in Cardano got clobbered -76%. I have high hopes this will recover next year. But it’s completely okay if it doesn’t. I only use “throw away” money to buy speculative investments.

Other assets not listed

Our net worth statement doesn’t include the following:

Automobiles and other personal property (< $20K): I drive a ten-year-old Toyota Prius C with 183K miles. My wife drives a 14-year-old Honda Pilot. Both increased their value because of the high demand for used cars. But we can agree that they do not amount to much.

My wife’s company pension (>$250K): Pensions are hard to value. If I were to add a lump sum value, it would be at the current present value. She will receive $1,753 per month for life if she retires at 55.

All in all, net worth is down by 5%

So why would a 5% decrease in net worth “not necessarily a bad thing”?

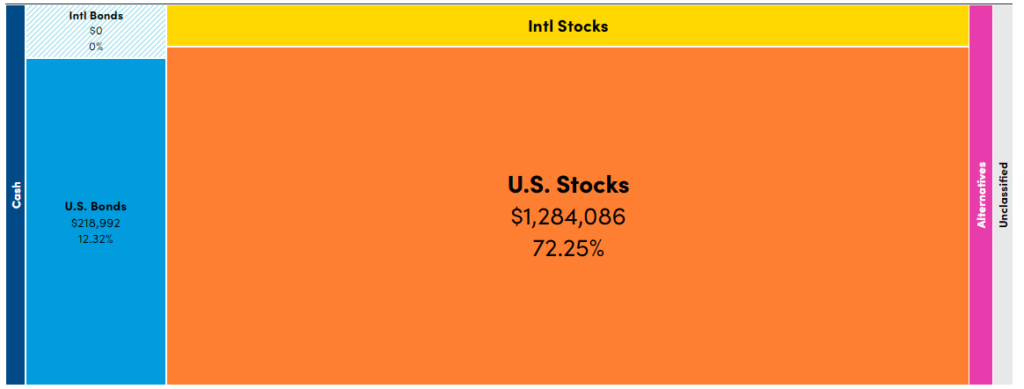

Our portfolio has a low beta number.

Beta is a measurement of how volatile a stock is relative to the overall stock market. A beta of 1, for example, means that our total investment return is strongly correlated to the stock market. I could potentially calculate a weighted sum of our investments to calculate the portfolio beta, but that would be pushing it. Taking into account real estate values, our stock holdings are, in reality, less than 60% of our total portfolio. Hence, it’s down by only 5% while the S&P 500 is down by 12.55% in the same period.

Asset prices are more reasonably valued.

Now is an opportune time to buy stocks at a discount. There are lots of reasons to be ecstatic: our DCA (dollar cost averaged) retirement contributions (including the additional “catch-up”) are buying more shares. And so are automatic dividend reinvestments.

By not selling and continuing to buy stocks in a bear market, the greater the likelihood that you will ultimately retire with a larger nest egg. Bull markets make you feel rich, but investing in bear markets is what will make you wealthy.

Bear markets are God’s gift to smart and patient investors like you and me!

See also: The Road to Riches Starts Here: Track Your Net Worth