I came to America in 1997 with only $500 in my pocket. It was a grueling 20-hour flight from Manila to Philadelphia. Coming from a third-world country, I thought that was a lot of money. So, midway through the flight, I bought a $100 Swiss leather watch, which I justified as a good buy because it was “duty-free.”

In hindsight, it’s clear that was stupid. I essentially spent one-fifth of my net worth indiscriminately on a consumer item I didn’t need just to impress the pretty stewardess serving me food. Had things turned out differently than initially planned, I would have ended up in the streets.

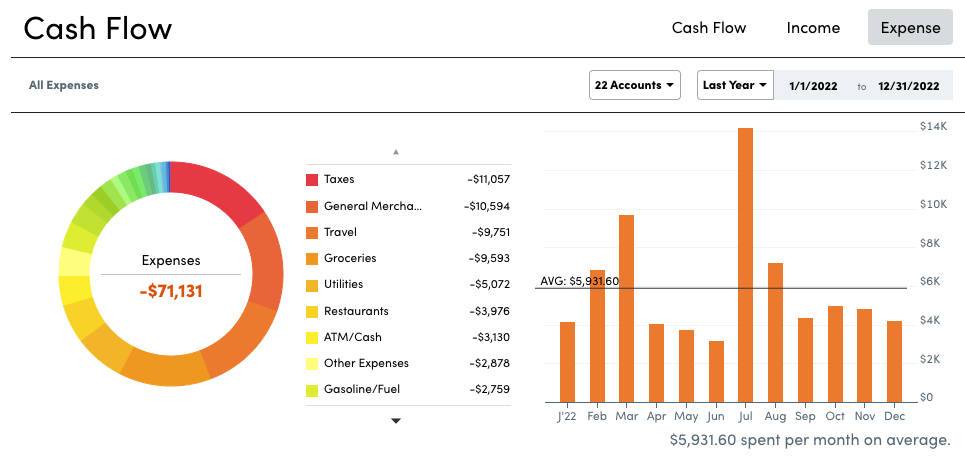

Now that I’m an everyday millionaire (and gazillion times smarter), it’s ironic that I track every single penny. Here’s how much we spent last year, for example:

Despite the record-high inflation rate, it’s actually $1,378 less than the previous year. Thanks to my religious year-by-year tracking of expenses! Who says your personal inflation rate must follow the nation’s inflation rate?

How I track our household spending

Tracking your spending need not be complicated. I’ve been using Personal Capital’s free tool for almost four years now. Enter all institutions you have an account with, and the tool aggregates everything into one unified stream of information while automatically categorizing each transaction.

Having tried other aggregators, I can confidently say: they have the best tool in the market today. I urge you to sign-up. However, be forewarned, marketers will try and contact you. And when they do, just politely tell them you’re not interested and they will leave you alone.

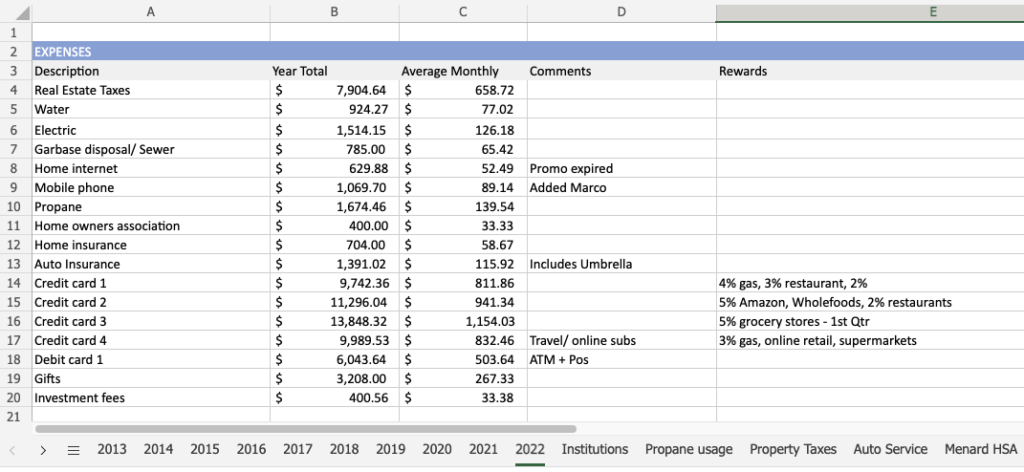

Otherwise, you can create an old-fashioned Excel spreadsheet like I also do. It requires more work but is well worth the effort. Creating both allows me to cross-check the figures with Personal Capital to verify the totals match.

It’s not as difficult as it seems. At the end of each year, I simply clone the last year into a new tab. Then, I manually sign in to each of my institution’s websites to download the YTD spending total, which I enter in the corresponding cell in the sheet. This way, I keep the history and can easily compare them to the previous year’s numbers. If I’ve substantially spent more on one item, say auto insurance, I’ll take proactive steps to reduce my spending next year by switching to another provider, for example.

Other expenses worth tracking in detail

I also have dedicated tabs for other items that need more detailed accounting:

- My energy bills

- Auto service

- Health saving account (HSA) qualified expenses

- Property taxes

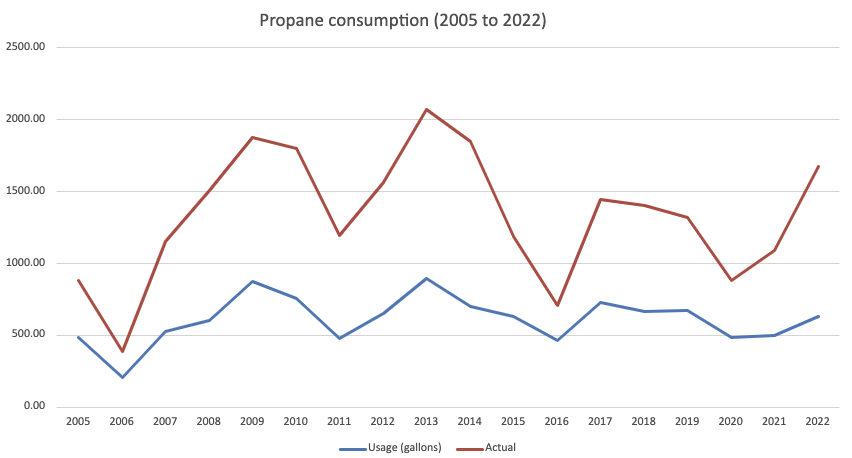

Being a data visualization nerd, I collect the data of bigger expenditures in a separate sheet before getting rid of the receipts. For instance, here’s a chart of my heating bills for the past 18 years:

Have you ever been up-sold by your local dealership stealership? Arm yourself with a spreadsheet similar to this during your next visit:

Take your time to review the service history before letting them do any work for you, and you’ll never have to pay for services you don’t need again.

I also have a tab for HSA-qualified spending. While I’m relatively young and healthy, I’m investing 100% of my HSA dollars in the stock market to get as much growth as possible. But I absolutely need to track my expenses so I can reimburse myself when I start claiming them in my taxes in the future.

Lastly, I have a special tab for property taxes. One of the benefits of having a paid-off mortgage is I no longer have to deal with an escrow company. I have to make sure I know what, when, and where to pay my taxes. I use the tab to organize this information independently from others.

Final thoughts

Tracking your spending can be a helpful tool for a number of reasons. It can help you understand your spending habits and identify areas where you may be able to cut back. It can also help you stick to a budget and save money.

Additionally, tracking your spending helps you detect unusual or fraudulent charges on your accounts.

Finally, having a clear picture of your spending can help you make financial decisions, such as whether you can afford a new monthly expense. Or whether you need to adjust your budget to reach your financial goals— like retiring early!

The 4% rule suggests saving 25 times your annual expenses is your ticket to financial freedom. You obviously wouldn’t know when to retire if you have no clue how much you are spending.

No Comments