I LOVE it… Don’t make resolutions, make goals. Resolutions are usually forgotten in the first 20 days of the years. But goals, goals are powerful.

P.S.

I LOLed louder than I should after I read about 69″ door 🙂

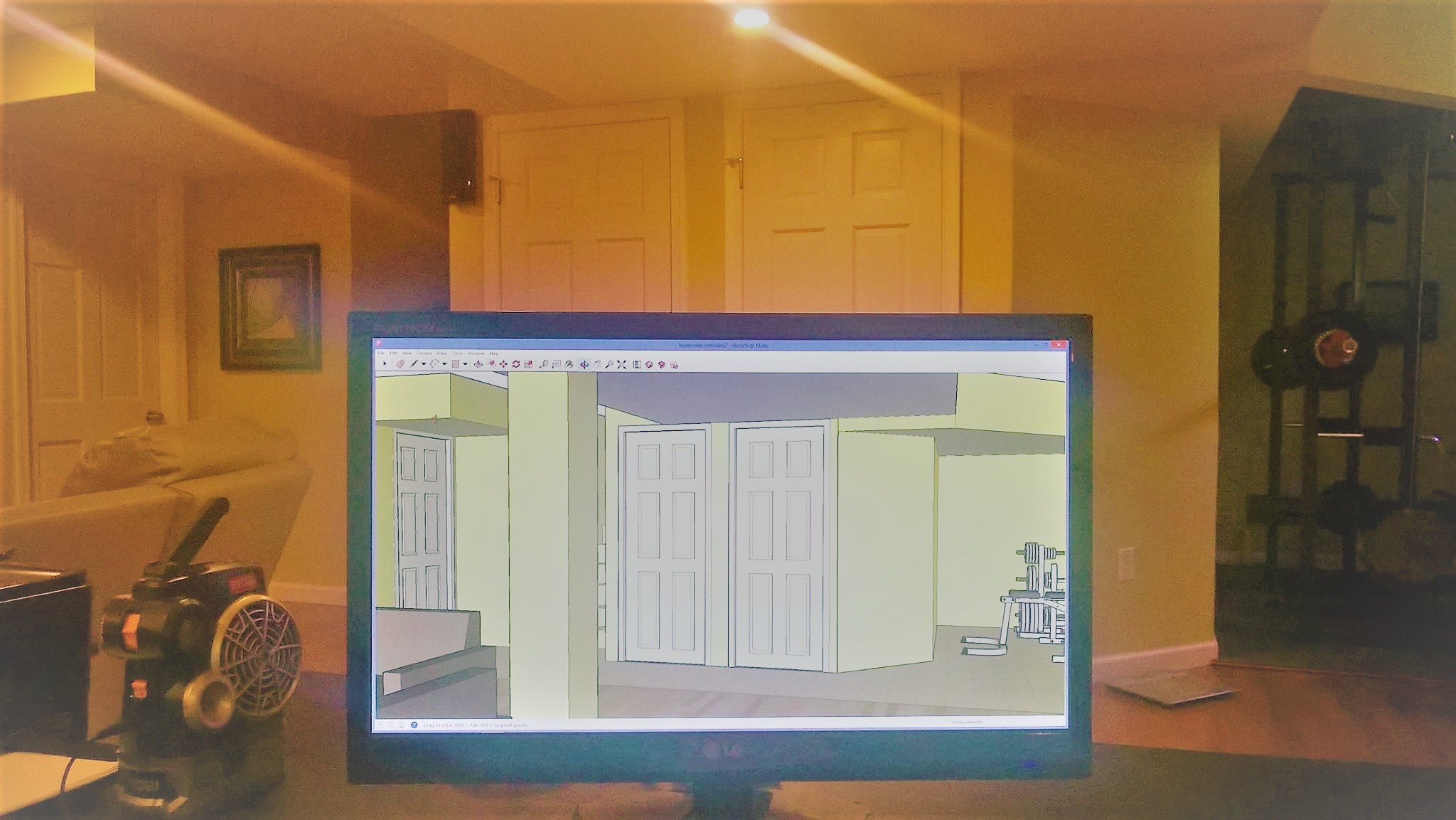

One of my proudest accomplishments is being able to finish our basement with my own hands. It now comes with a full bath, laundry room, home theater, and a mini gym. I did most of the labor myself, including the electrical and plumbing, working mostly weekends with occasional help from my teenage son and a “not-so-handy” handyman. Before this undertaking, the only home improvement that I’ve done was painting a wall.

Since I knew nothing about home renovations, I relied mostly on watching YouTube videos before performing a task. It took me two years from conception to realization, but it was all worth it as I’ve acquired all the necessary skills needed to become a badass DIY homeowner. Even though halfway through the electrical project, I became too confident and almost got electrocuted.

I did know C.A.D. (Computer-Aided Design), as I’ve learned from my brothers, who were experts in the field. So every nook and cranny was modeled in 3D before I started hitting the first nail with a hammer.

Had I not started a detailed plan, I would not have finished the project. The same is true had I been electrocuted, but that is another story.

Whether it’s for losing weight or growing your net worth, you too can benefit from creating a plan. Writing a detailed plan is way better than merely making a New Year’s resolution. And there’s no better time to do it than at the start of the year.

I’ve always been a huge believer in the value of planning. It reduces risk, increases efficiency, and helps achieve objectives. You can list down your needs or wants in practical terms and then evaluate what it will take to satisfy them. Creating a specific plan will give you a better chance of meeting those goals.

When it comes to goals, make sure it’s S.M.A.R.T.— I named this blog “Millionaire Before 50” because it’s Specific, Measurable, Achievable, Realistic, and Time-based. Becoming a millionaire by age 50 is a realistic and achievable goal for most people.

For example, my short-term financial goal is to reduce our spending by 10% by the end of 2021. I know it’s achievable because I kept track of our expenses last year.

The next step is to list down a plan to meet that specific goal. For example:

It’s also important to set a deadline for each action item when applicable. That way, the plan is more tangible and not a mere wish list.

Having specific goals doesn’t necessarily mean one is committed to achieving them. Most of us want to become wealthy, but only a few spend the time, energy, or effort required to realize this goal. Even the best financial plans are ineffective if you don’t follow them.

Motivation alone is not enough. It’s usually short-lived and doesn’t always lead to consistent action.

A detailed blueprint that tells you how and when you’re going to execute them should help you focus and stick to your plan and ultimately achieve your goals.

Being able to follow a plan is one thing; being able to execute correctly is another. Follow best practices instead of listening to your broke brother-in-law or co-worker. Learn the habits of wealthy people instead.

Build your competence, read books from reliable sources, and learn more about investing and personal finance. Understand the difference between a mutual fund and an ETF, for example.

The “not-so-handy” handyman that I hired to help me finish my basement was incompetent. I asked him to construct a door frame with a standard height of 6’9″. I came home that night shocked to see a midget 69″ door frame instead.

More so, he didn’t lay the studs in the exact position I had in my blueprint. It was off by many inches despite my meticulous planning— I had to tear it down. I ended up completing the rest of the project myself.

Mike Tyson once said, “Everybody has a plan until they get punched in the mouth.” Know when to reset your course when the thing that we call life hits you: a new baby, a disastrous divorce, a job loss, or any other life-changing event that can take you on an unexpected personal or financial detour. You may need to re-evaluate both your goals and your plans for achieving them.

Investing takes time— you have to be committed and vigilant in adhering to your plan. And if you get sidetracked by a life event, chances are you can recover from it.

Start a plan, not a resolution this coming new year.