Thanks for sharing this great post, it was very helpful

How to Protect Yourself from Rising Inflation

- By : Menard

- Category : Financial Planning

- Tags: inflation rate, lifestyle inflation

Talks about inflation have been the rage across news outlets and social media lately. Biden’s $1.9 trillion coronavirus stimulus package is freaking out too many stock-market pundits faster than the vaccine rollout. Some are probably on drugs to even suggest it could reach hyperinflation levels. This fearmongering has led people into thinking, “how do I protect myself from rising inflation?”

Inflation is when prices rise because there’s too much money in circulation and not enough goods and services to spend it on. On the other hand, hyperinflation is inflation on steroids— think about 1000% instead of 10%. I don’t think it’s ever going to happen unless the U.S. dollar ceases to be the world’s predominant currency.

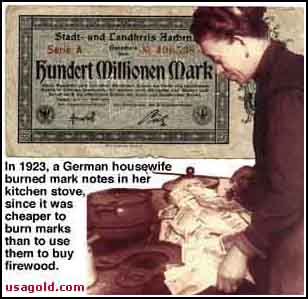

Hyperinflation often occurs during war, turmoil, and economic collapse: French Revolution (resulted in the fall of the monarchy and their beheadings), Weimar Germany (which brought Adolf Hitler to power) in WW1, and Japanese occupied Philippines (a former U.S. territory) in WW2.

While there’s no solution to hyperinflation— other than a plane ticket to another country or maybe owning Bitcoin— normal inflation is controllable if you know what you’re doing.

The inflation cycle

What the pundits fail to explain to the general public? Inflation is just a part of the regular economic cycle.

- When demand increases: If twenty people want to buy new houses and only five are available, the builder can increase the price because some will pay more to get the house they want.

- Prices go higher: The ones who can’t afford the houses— including the workers building the houses— demand higher wages— so they can afford to buy a house. The cost of building the house goes up, and the selling price also goes up.

- When demand decreases: And when housing prices cost more than people can afford, they stop buying. Demand for new houses stalls and the builder lays off workers. Since unemployed people buy less of everything, the economy turns into a recession.

- Prices go lower: The builder— desperate to sell their small inventory of houses— offers a discount to attract more buyers.

And the cycle begins again.

Effects on everyday prices

If a hypothetical (and severely demented) real-estate investor hid $100,000 “under the mattress” in 1965, totally forgot about it for 50 years, and then suddenly remembered in 2015, he’ll be shocked to see that the money he saved to buy four houses can only buy three cars.

It’s only been like six years since 2015, and the average cost of a new car and new house in 2021 is now $40,857 and $408,800, respectively.

At that rate, can you imagine how much it would cost to buy a new car or house in 2071??

Fortunately, there are timeless ways to protect yourself from inflation.

Invest in stocks

Warren Buffett believes no other asset class can protect you from this “invisible tax” we call inflation. One reason is that successful companies can pass rising costs to consumers. Especially true for makers of goods that many consumers depend. Not to mention stocks provide the best rate of return over bonds and other asset classes.

Many companies also offer dividends— regular payments paid to shareholders. These payments have shown to provide a strong hedge against inflation. There are many blue-chip companies, for example, that are known to pay dividends that are higher than the rate of inflation.

Lock your housing costs

Assuming you bought a house you can afford and took a fixed-rate mortgage, owning your own home is an excellent hedge against inflation because you are locking a significant portion of your housing costs. For starters, your mortgage payment remains the same while rental prices continue to go up, year after year.

The caveat is you need to stay in the house for an extended period. Otherwise, you won’t be able to recoup the thousands of dollars you would have spent on closing costs and real estate commissions.

If you took an adjustable-rate mortgage, however, your loan is tied to an index. Your payments automatically adjust for inflation in favor of the bank. In such a case, you should refinance to a lower fixed-rate mortgage to lock your living costs.

Give yourself a raise

Not only is your income your most powerful wealth-building tool, but it’s also the best weapon that you can use to fight higher prices. Nothing is more effective in combating inflation than investing in yourself to increase your earning potential.

Inflation often occurs when unemployment is low, and there’s a lot of buying power in the economy, like what happened after WW2. The inflation rate grew double digits due to a sudden rise in demand for goods from soldiers returning home with lots of back pay. With lower unemployment, you should consider switching to another job that pays more.

Control lifestyle inflation

There’s a reason why the Fed raises interest rates during inflationary periods. Higher rates encourage people to save more. When people start saving, they buy fewer goods. Consequently, there’s less demand for goods, which results in prices going down.

So don’t let the Joneses (or the Kardashians) dictate how you spend your money. Chances are they are broke trying to keep up with others. Focus on things that are important to you instead– but within your budget!

In the end, your personal inflation rate doesn’t need to keep pace with the country’s inflation rate. Unlike the latter, you have control over your spending.

Control your spending before it controls you!