Don’t Make a New Year’s Resolution, Start a Plan

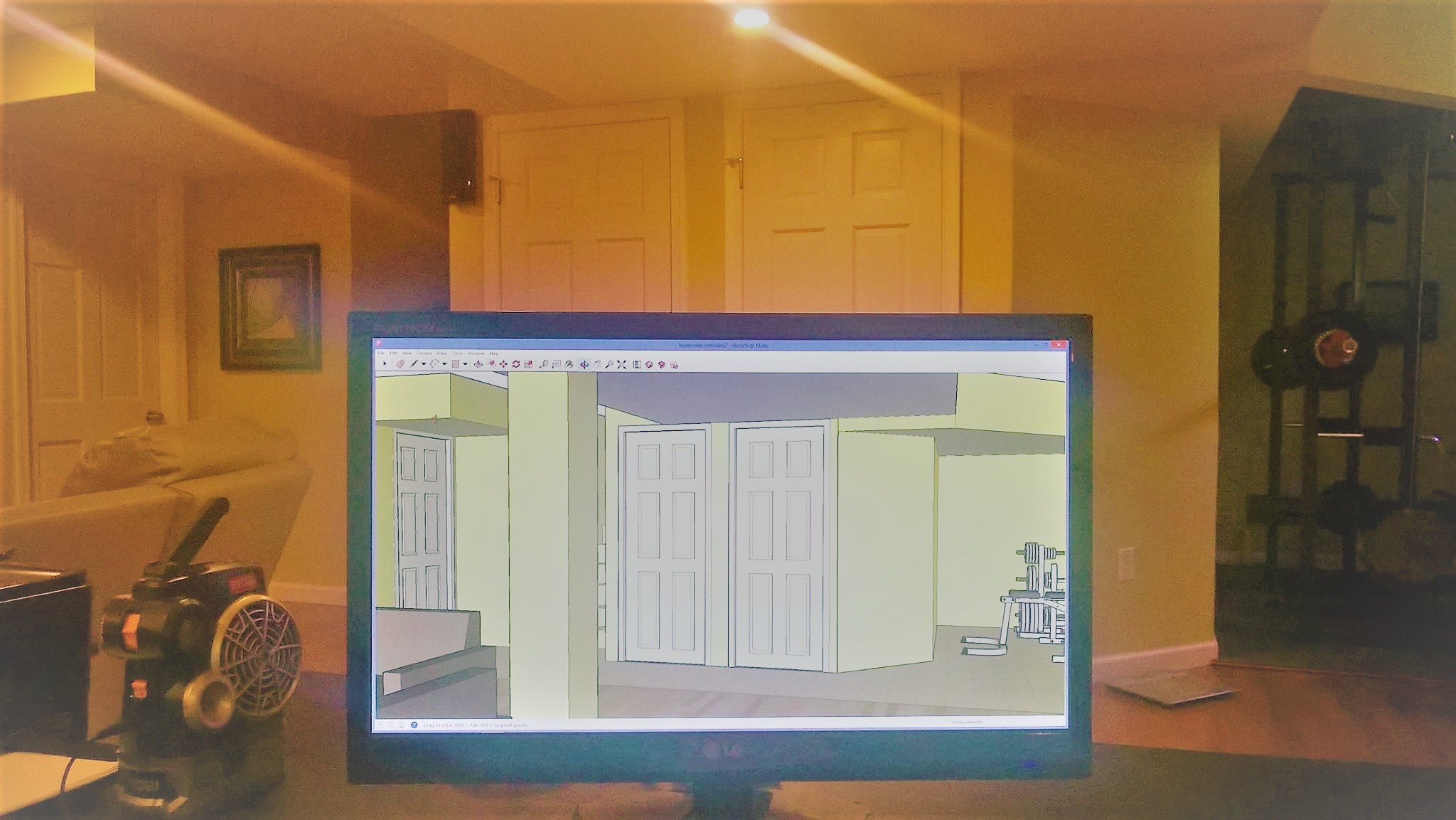

One of my proudest accomplishments is being able to finish our basement with my own hands. It now comes with a full bath, laundry room, home theater, and a mini gym. I did most of the labor myself, including the electrical and plumbing, working mostly weekends with occasional help from …

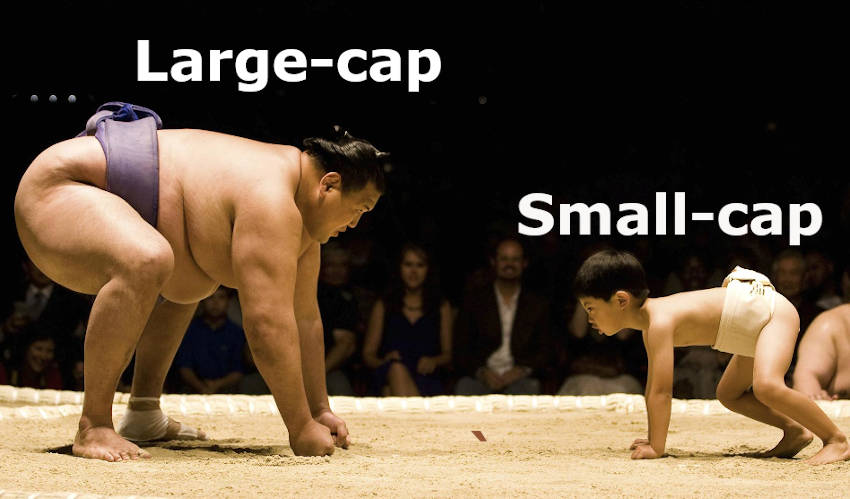

News Flash: The S&P 500 is Not the Stock Market

I’m not going to lie to you. Financially, it has been an excellent year for us as a couple. With no mortgage to think about and the kids’ college savings almost funded, our cash reserves have been piling up faster than we can invest. If Trump’s win, four years ago, …

Give Cash on Christmas Day, No Greater Gift is There Than Cash

At least that’s what I think former Wharton professor and economist Joel Waldfogel is implying in his book Scroogenomics: Why you shouldn’t buy presents for the holidays (Princeton University Press).

In a 2012 interview with Bloomberg, Waldfogel argues that Americans end up wasting billions of dollars on presents during the holiday season every year:

“Normally, when we spend money on ourselves we only buy things that they’re worth at least the price. So if I see something worth $50 to me, I’ll buy it. Normally, spending provides some measure of satisfaction.”

He then contrasts this to giving gifts to others.

“Gift giving is really different. If I set up to spend $50 on you, I’m operating at a huge disadvantage– I don’t know what you like or what you already have. I could spend $50 and buy something that is worth nothing to you.”

The First Million is the Hardest (here’s how to make it easier)

As cliché as it sounds, the first million is the hardest. Having achieved recently my second in four short years instead of fifteen— saving for my first— is a testament to this. But why exactly is that? The short answer is it takes money to beget money. The more money …

The Shortest Path to Wealth is Not Necessarily the Best Route to Take

What is the shortest path to wealth? Frankly, I have three words for you: “Marry for money.” Either that or “Win the lottery.” Neither is realistic nor practical unless you happen to be extremely attractive or incredibly lucky. If you ask a few personal finance gurus, however, you’ll get differing …

Dying Without a Will Could be Your Ultimate Horror Story

My first real encounter with death occurred while I was in Manila many years ago. I was riding a cab on my way to the City Hall when I was awakened from my short nap by the driver who was frantically exclaiming in Tagalog, “May tao, nasagasaan ng trak!” A man …

The Kingmaker: a Damning Documentary of Imelda Marcos’ Greed and Excess

If you haven’t heard of Imelda Marcos’ legendary 3,000 pairs of shoes, it’s either you’re too young or live under a rock. Imelda Marcos was the Evita Peron of the Philippines, only greedier and more corrupt. Her conjugal dictatorship with the late president, Ferdinand Marcos, is listed in the Guinness …

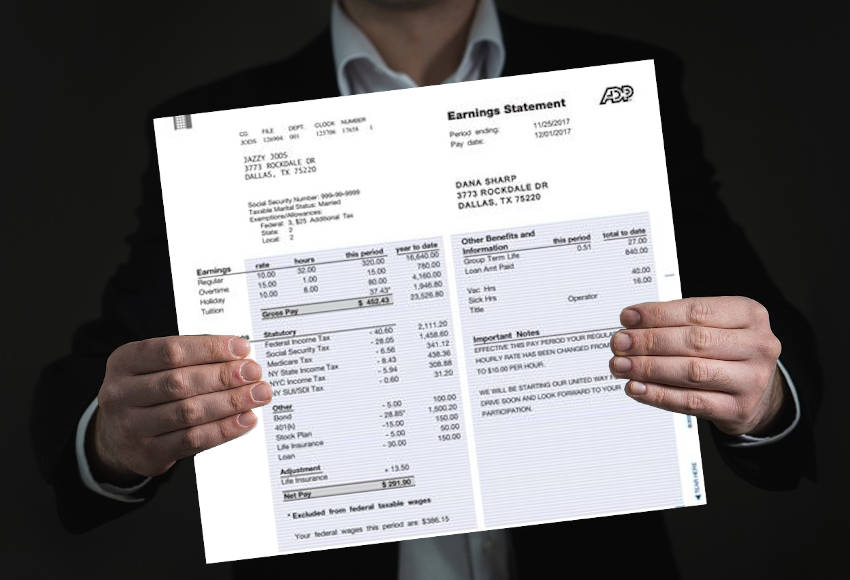

The Anatomy of an American Paycheck

If only more people paid attention to their paychecks than credit limits, we would have less poverty, homelessness, divorce, and more happy millionaires who don’t stress about money.

Net Worth Update: Four Years Later

While this might come off weird for people outside the FI community, sharing our household net worth over the internet is a Labor Day tradition that I’ve observed since I started the blog four years ago. It’s all for transparency, accountability, and validation that the lessons I’ve been writing about …

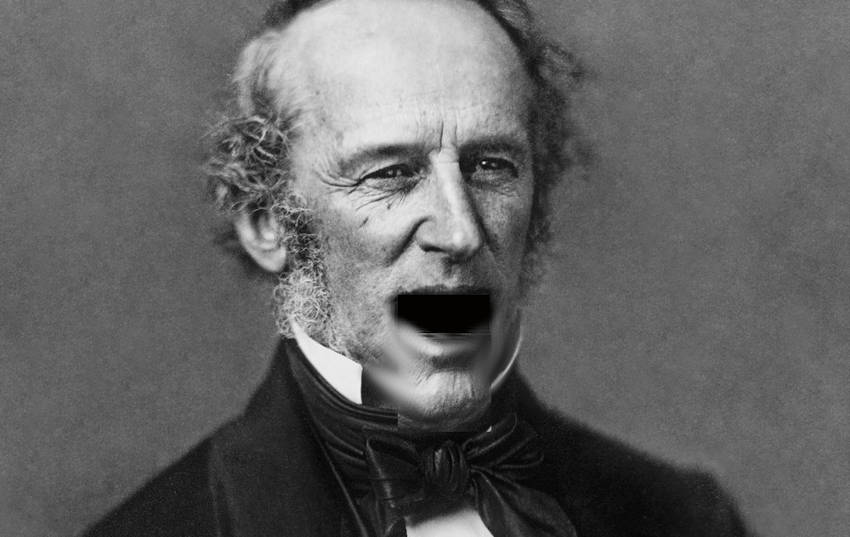

How the Vanderbilt Heirs Squandered the World’s Greatest Fortune

A common adage among wealth advisors is “The first generation makes it, the second maintains it, and the third blows it.” Succeeding generations are left scratching their heads in wonder where the money went. No one epitomizes this better than the Vanderbilts. Considered as the first tycoon, Cornelius “The Commodore” …

Recent Posts

Recent Comments

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing31

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3