I love how you broke all of this down. The sad reality is that THIS is how most Americans currently live!!!!!

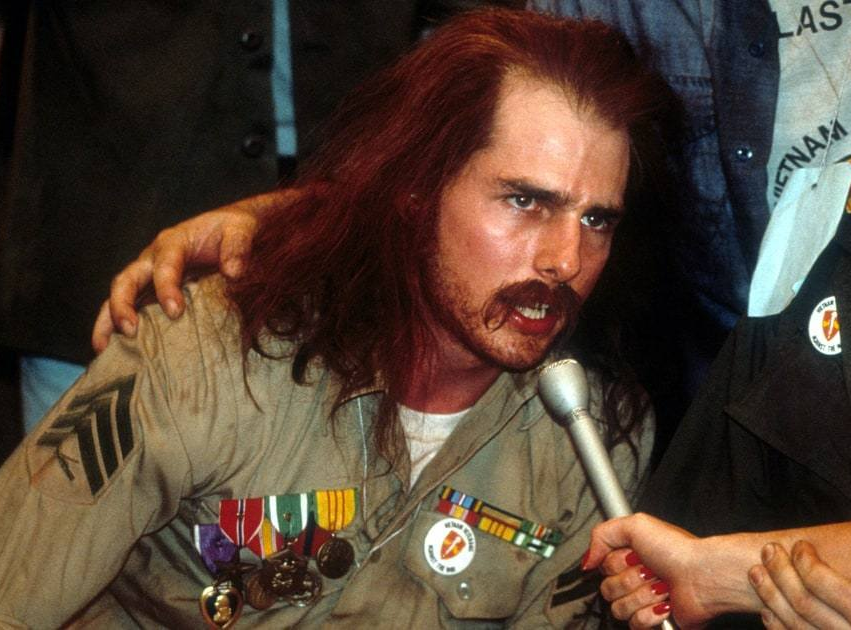

Broke on the Fourth of July

- By : Menard

- Category : American dream

Coming from the eyes of someone who grew up in a third-world country, living in America is an enormous privilege. No other country can provide you with the same opportunities for success and wealth-building as the United States of America.

Being born an American is like winning the genetic lottery–- you immediately have a massive leg up in life. None of the billionaires you admire, may it be Jeff Bezos, Bill Gates, or Warren Buffett, would have reached the same level of success had they been born elsewhere. Yet many Americans still do idiotic things that render them too broke to celebrate independence day.

Yes, it’s true that sometimes they find themselves in deep water because of some health crisis, natural disaster, or an ugly divorce. However, most are in debt because they buy things they can’t afford. “I want it now” has always been their mantra.

In fact, according to a Nielsen study, one in four American families making $150,000 a year or more is still living paycheck-to-paycheck, while one in three earning between $50,000 and $100,000 also depend on their next check to keep their heads above water.

How does that happen? Well, here’s how you can burn your money like fireworks on the Fourth of July:

Car payments that rival mortgages

Not long ago, the longest term for a car loan was five years. Now the average loan term for a new car is 72 months. A few lenders can even give you a 96-month loan under certain circumstances— like when you’re buying a luxury car you can’t afford from a motivated dealer. No wonder, my coworker who is saddled with student loans now has two Teslas sitting in his garage to take advantage of “Federal Tax Credits.”

Sure, you have two shiny new EVs to show off your status and you’ll feel like a superstar. But is it worth it? Even with the tax credits, you’d be paying $750 for 72 months for a new Model Y. That’s $1,500 for a couple!

Let’s see how much the same amount will grow if invested in the S&P 500 over a 20-year period (seven years less the time I’ve been working in America).

Are two Teslas worth a million dollars to you? Well, at least your garage has “near zero carbon emissions.” Except for, maybe, a third vehicle used for transporting the family dog.

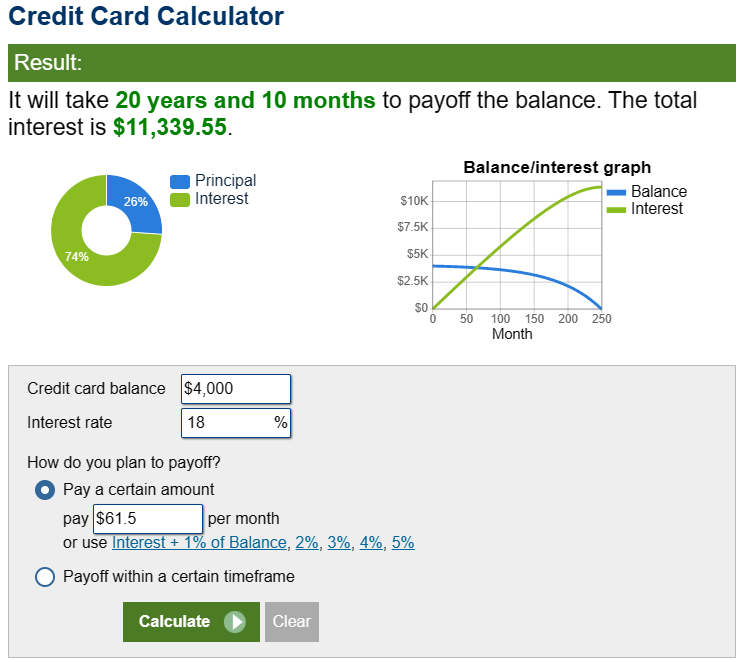

Keep a balance on credit cards, pay the minimum

Credit cards are awesome. It lets you buy things you don’t need, with money you don’t have, at interest rates, you can’t afford. It helps you build a mountain of debt that will haunt you for years, ruin your credit score, and stress you out. It teaches you valuable lessons about how to live beyond your means, ignore your budget, and pay the minimum balance. It makes you feel like a winner, even if you’re a loser. Why would you ever want to avoid credit card debt?

It will take you only two decades to pay off a $4,000 credit card at 18% APR if you only pay the minimum. By then, you would have paid only $11,399.55 in interest. No big deal.

Except that credit card companies are laughing their arse off, thinking of you as a very lucrative stock investment on steroids. Where else can you earn a steady 18% return in the stock market nowadays?

Go to or pay for fancy universities

Forget about learning from books, lectures, or professors. The real learning happens in the parties, the frats, and the sororities. That’s where you’ll learn the valuable skills of networking, socializing, and drinking. You’ll also learn how to deal with stress, pressure, and competition. Everyone knows that fancy universities with breathtaking views, gourmet food, and world-class gyms are the places where all the cool kids go.

Forget in-state public or community colleges exist. I know a couple who drove their college-bound kids out of state for private university tours. Now their twins have over $80,000 in student loans each and growing at impressive levels! Not to mention spending a lot of time and a ton of money buying airline tickets so they can see them.

That’s what happens when you let 18-year-olds decide where to go. Still can’t get a job after graduation? How about another loan for a master’s degree? Parents, show your enduring love by co-signing for these loans for the kids.

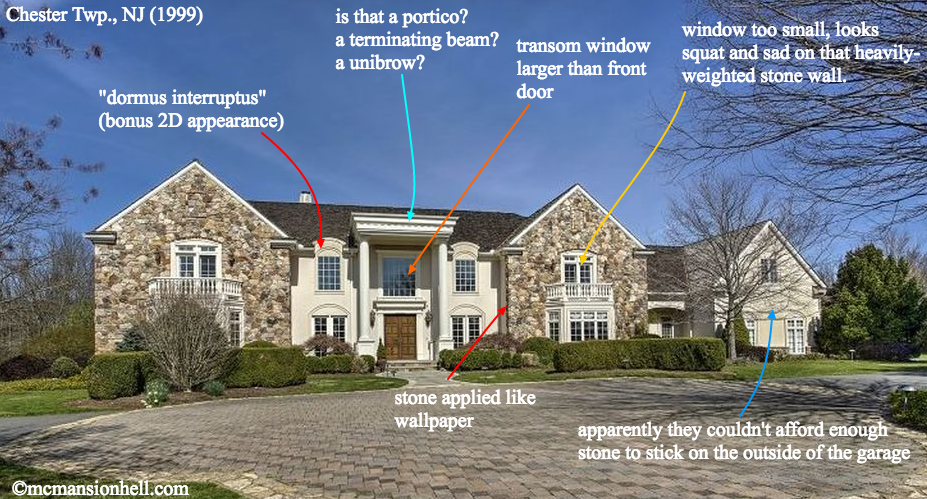

Live in a bigger house to keep all your stuff

You need to show the world how successful you are by living in a huge and beautiful house, even if it means living paycheck to paycheck, or worse, going into foreclosure. You need to enjoy the benefits of having a bigger house, such as more space, and more rooms to keep all your stuff. You need to be proud of your home, even if it means being miserable, stressed, and broke.

And while you’re at it, don’t pay the mortgage off. Extend to another 30 years, so you can do a cash-out refinance. That way, you can get extra money to spend on whatever you want, like vacations, cars, or clothes. You need to be happy in your home, even at the risk of bankruptcy.

Throw extravagant weddings

You should throw an extravagant wedding even if you can’t afford it because it’s the only way to celebrate your love. Who cares about the cost, the debt, or the stress? All that matters is the spectacle and the memories of the wedding. You need to show the world how much you love each other by throwing a lavish wedding that’s way beyond your budget, even if it means starting your marriage in financial trouble, or worse, divorce.

You need to enjoy the benefits of having an extravagant wedding, such as impressing your guests, pleasing your parents, and fulfilling your fantasies. You need to be happy on your wedding day, even if it means being miserable, anxious, and regretful afterwards.

Throwing an extravagant wedding even if you can’t afford it is the best decision you’ll ever make. Trust me, I’ve been married twice.

Lottery tickets, sports betting, and other forms of gambling

Spending your hard-earned money on lottery tickets is a great way to ensure that you’ll never have to worry about having too much money. It’s also a fantastic way to support the government and the lottery companies.

Who needs financial stability when you can have the thrill of winning? And who needs to save for retirement when you can spend all your money on scratch-offs? At least with Amazon purchases, you have something to show for it. So go ahead and buy those tickets! You never know, you might just win big and be able to retire in style… or not.

Your chances of winning the jackpot are about as good as your chances of being struck by lightning while being attacked by a shark. But hey, at least you’ll have a good story to tell if it ever happens!

Final thoughts

Of course, there are an unlimited number of ways you can go broke in America. But the above are the most significant and idiotic. So don’t discount the ones that can add up like the $5 latte or Hulu subscriptions you barely use. As one of our Founding Fathers, Benjamin Franklin, once said, “Even small leaks can sink a great ship!”