Young adults should serve. You get so much for free its unbelievable! Serve your tour or stay for the 20 years and retire and get a nice pension. What you’re learning is completely up too you. Just think about the benefits and what the complete package is.

Can You Retire from the U.S. Military as a Millionaire?

- By : Menard

- Category : Career, Retirement

Retiring as a millionaire is probably the last thing you’d think about when joining the military. To serve the country is on top of the list. Besides, any financial gain you get from the government wouldn’t offset the sacrifices you have to endure:

- Rigorous training (10-13 week boot camps in the case of the Army and Marines)

- Physical and emotional hardships away from family and friends

- Enormous responsibilities that have real, tangible consequences of failure

Not to mention the possibility of being killed or incapacitated in combat. However, the RESPECT you’ll garner from the general public, including from yours truly, is priceless.

Since Memorial Day has just passed, I thought of writing this post as a tribute not to the dead but to the patriotic young men and women who have chosen a challenging career in the military to fulfill their calling. I say thank you for your service.

Grandpa’s pay as a U.S. Navy sailor in World War I

My grandpa was a U.S. Navy sailor aboard U.S.S Arkansas (1914-1918) as a young man. He was honorably discharged shortly after World War I. His total pay per month while in service was $17. At the time of his discharge, he was paid $145 in full and $38 per month in benefits, thereafter.

I’ve found out about all those numbers by obtaining a copy of his service records from the National Personnel Records Center archives.

He retired in the Philippines with a pension that enabled him to buy real estate properties in various parts of the country. He was essentially earning in U.S. dollars and spending in Philippine pesos which made him relatively wealthy. This was almost a hundred years before geo-arbitrage became a popular lingo in the Financial Independence community!

Whether or not he became a millionaire in inflation-adjusted terms, I don’t really know. But he was known for having “boatloads of money.” Even the notorious dictator (then-congressman), Ferdinand Marcos, approached him for campaign donations.

As a side note, I also learned that his ship was one of those that sank in a pair of nuclear weapons tests, codenamed Operation Crossroads, conducted by the U.S. in the Pacific.

How much does the United States pay our soldiers now?

“That’s a great story, but can I become a millionaire by joining now?” You might ask.

The short answer is yes. As in any other profession, you need to be creative with your finances like my grandpa or steadily climb the ranks to get raises. More importantly, live below your means, so you have “boatloads of money” to invest!

Regardless of which branch you decide to join— Army, Navy, Airforce, Marines, Coast Guard, or Space Force (yes, it’s a real thing), the benefits and pay are generally the same. Your rank determines your pay grade.

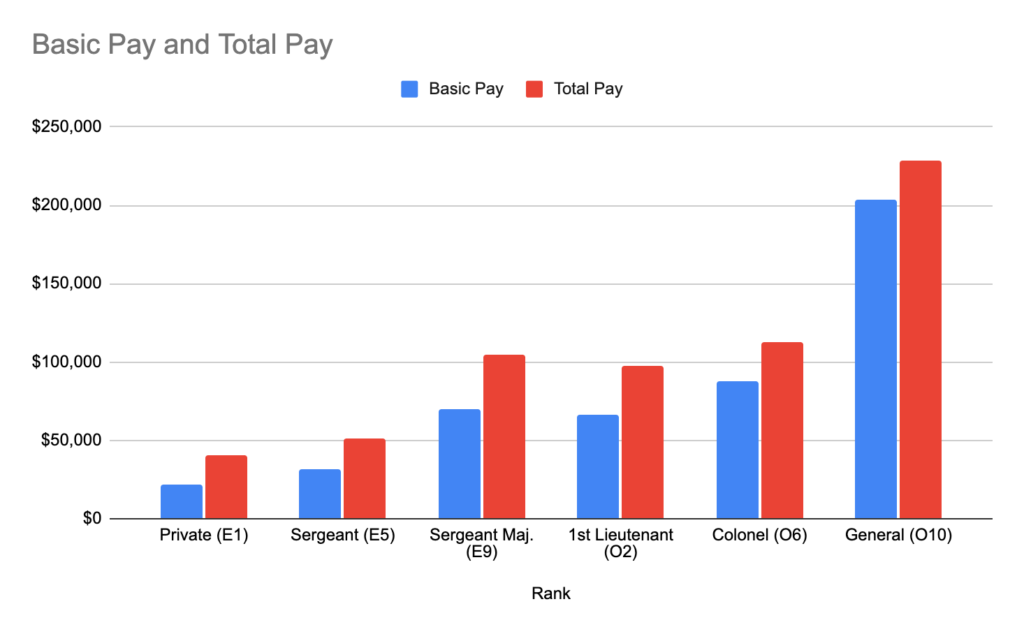

Ranks vary across military branches, but pay grades do not. As a private in the Army or Marines in 2022, the starting pay is $1,833 per month (pay grade, E1), while $2,610 (pay grade, E5) for a Sergeant. Work your way up to Colonel, the highest field-grade officer, pay triples to $7,332 (pay grade, O6). Attain the highest General or Admiral rank, and your pay jumps to $16,975 (pay grade, O10) or around $200K per year!

In addition to the basic pay, you have various allowances:

- Basic Allowance for Subsistence (BAS), which is adjusted yearly based on the price of food

- Basic Allowance for Housing (BAH), which depends on your location

- Overseas Cost of Living Allowance (OCOLA)

A majority of the force receives BAS and BAH for food and housing, respectively. Both are a significant portion of the member’s total pay. The great thing about these allowances is they are not taxable!

You can view a comprehensive summary of the benefits here.

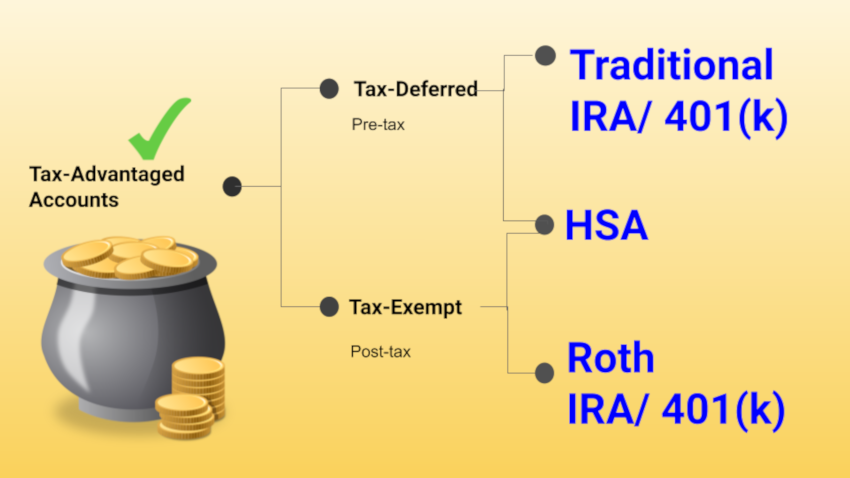

The Thrift Savings Plan or TSP

The Federal Government offers the same type of savings and tax benefits that many private corporations offer their employees under “401(k)” plans. You can read about it and other tax-advantaged accounts here.

With a Roth TSP, you can contribute as much as $20,500 per year. You can invest in three major funds:

- G Plan (Government Securities)

- C Plan (Common Stock Index)

- I Plan (International Stock Index)

The C Plan is essentially a mutual fund that tracks the S&P 500, a broad market index made up of stocks of 500 large to medium-sized U.S. companies. This includes great companies like Apple, Microsoft, Amazon, and Google.

Notwithstanding the recent downturn, the C Plan, which historically averaged a 10.6% annual gain, has produced a lot of millionaire TSP participants over the long term.

How to retire from the military as a millionaire

Working your way up the ranks will surely help. After all, your income is your most powerful wealth-building tool. But here’s a little secret: you don’t need to be an officer to become a millionaire!

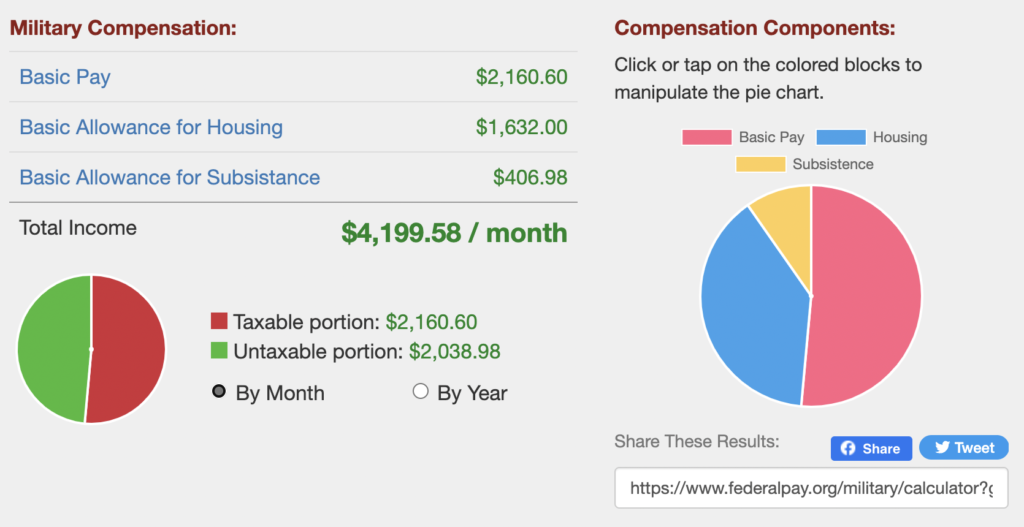

Suppose you’re a Private First Class with less than two years in service. If you live where I live, your total compensation, including BAH and BAS is $50,394.96 per year.

That translates to $4,199.58 per month as shown in the chart below:

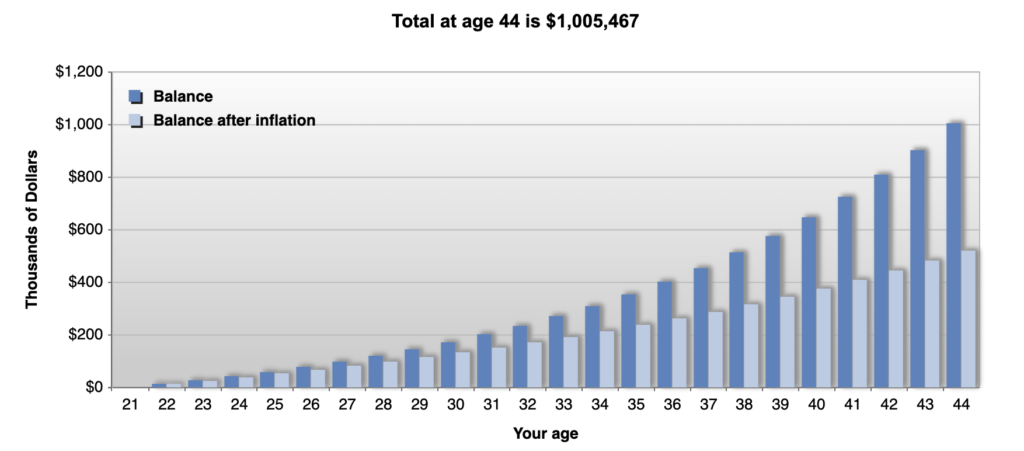

If you consistently invest roughly half of your basic pay, $1,000 a month in the C Plan:

- Age: 21

- Annual contribution: $12,000

- Investment rate of return: 10%

At age 44, you’ll reach your $1 million goal. The catch is you won’t be able to withdraw all your funds until you reach 59 1/2, but there are ways to avoid the penalty.

The key is consistently socking away a thousand dollars a month or more. It may seem challenging at first. But as a “badass” enlisted personnel who is used to difficult life inside or outside the battlefield— you should be able to do it.

If you manage to control lifestyle inflation, you can gradually bump up your contributions. Imagine how fast you could become a millionaire as you work your way up the ranks.