Just came across your website and it’s got fantastic content that is on the mark for where I am in life. Thank you!

From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- By : Menard

- Category : Saving for college

As a parent of a recent high school graduate, discarding junk mail from overpriced colleges and universities across the country has become my new hobby. These institutions relentlessly compete for my hard-earned dollars—or rather, dollars they expect my daughter to borrow from opportunistic lenders who seek an unfair slice of the bounty.

Sadly, many parents succumb to this trap by co-signing loans believing it’s for their kids’ bright future. A future that could turn dreams into a financial nightmare, burdening both the parents and the students with overwhelming debt.

Certainly not me. On the contrary, I enjoy ripping apart mail from Sallie Mae, the largest private lender, enticing my 18-year-old to take “Smart Option Student Loans” that supposedly provide 4.25% and 5.37% fixed and variable rates, respectively. But the small print says it all, rates could go up as high as 15.7%!

Forget Sallie Mae. As someone who successfully saved for college for three children, trust me. If you have a reasonable income, neither you nor your kid need to borrow for college. Start investing inside a tax-sheltered 529 account instead.

Why invest in a 529 account?

529s are state-sponsored investment vehicles specifically designed for saving for college. Unlike a Roth IRA, it has very high contribution limits and no income limitations. Not to mention, gains are tax-free as long as they are spent on tuition, board, books, etc. It’s simply the best college-saving vehicle.

The only drawback is you could be penalized 10% on the gains if you withdraw for non-qualified expenses. Fortunately, recent legislation makes the distribution more flexible than ever. Starting this year, you can roll up to an aggregate lifetime limit of $35,000 into your beneficiary’s Roth IRA, for example.

Besides saving money on federal taxes, many states offer special tax savings. My state, Pennsylvania, offers state income tax deductions and protection from PA financial aid reporting, for example.

Open a 529 as early as possible

Many parents start saving two or three years before their children go to college when the time is not on their side— big mistake! Like your retirement savings, the earlier you start, the more time your investment will grow. This is especially true if the funds are invested in stocks.

In my case, I started a 529 account for our younger kids as soon as my wife told me she was pregnant. As a result, we now have over $250,000 saved for our two children. But not so much with my first as I started contributing to the account when he was 12. Still, the account helped shoulder his expenses tremendously.

Open a 529 as soon as your child is born. However, make sure your child is likely to attend. If you and your spouse went to college, you can expect that your child will. Kids tend to follow in their parent’s footsteps.

Invest aggressively from the start

529 plans often offer choices between a pre-paid tuition or a savings plan. Don’t make the mistake of investing in the pre-paid or “guaranteed to keep up with inflation” plan. Sure, public institutions have averaged an annual growth of almost 9%. But there are a lot of restrictions on how you can use the money. Some plans limit qualified withdrawals on college tuition and fees, for example.

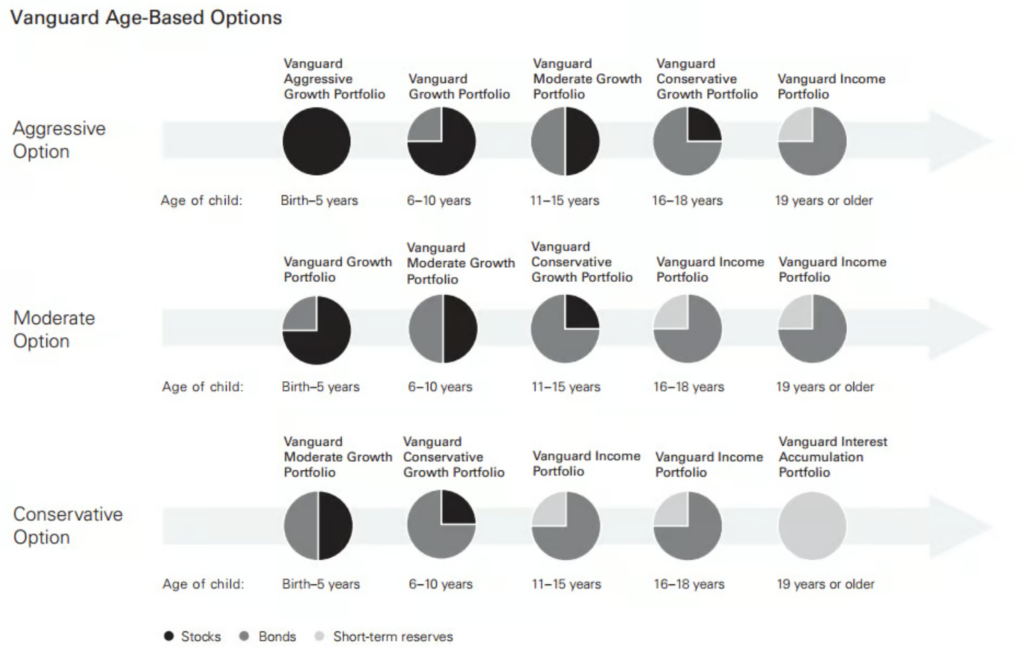

With the savings plan, you can invest 100% in a total stock market fund that averages almost 12% over the long haul. That’s exactly what I did until my kids were only 5 years away from college.

Now my daughter is an incoming college freshman, my portfolio is 50/25/25 stocks, bonds, and short-term reserves. I didn’t follow Vanguard’s recommendations as I find them too conservative.

Should the stock market take a temporary nose dive, I don’t need to sell. I could pull funds from the fixed-income part of the portfolio. I could even pull funds from another beneficiary. 529 accounts let you transfer funds from one beneficiary to another.

Send your kid to an affordable institution

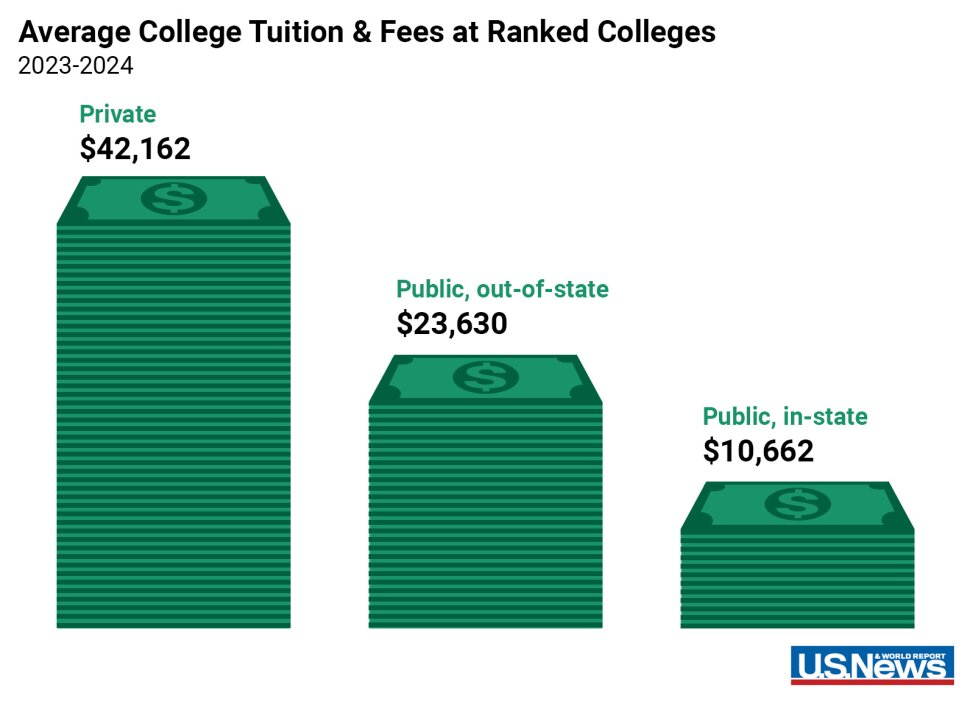

Fully funding your child’s education with a 529 is a challenge if you pick a school that will cost you an arm and a leg. Sure, you can plan on saving $750,000 for college like what the Financial Samurai is doing. But if you’re smart, send your kid to a more affordable university instead.

Most employers don’t care where you completed your degree anyway. My parents paid peanuts for my college education in a no-name school in the Far East. And yet, I still ended up earning six figures, bumping shoulders with Ivy League kids.

Don’t let your 17-year-old sway you on an expensive out-of-state college tour either. They have no idea what it takes to pay off a $200,000 student loan debt. They can easily be enamored by the nice facilities offered by these overpriced American educational institutions.

Other ways to save money

Taking Advanced Placement (AP) classes could be credited to college. My eldest son did this allowing him to finish his Computer Science degree one semester early. It pays to have excellent academic credentials. I’d encourage them to apply for scholarships, internships, etc. to help pay for tuition and other expenses.

Let your kid live with you while attending college. The college experience is not worth getting into debt. Think about the savings you could make on room and board.

Community colleges, for example, are looked down on by some as a loser school. But if your kid spends the first two years in one and then transfers the credits to a real college you can be proud of— you’ll both come out as a winner!

See also: Why You Should Save for Your Kids’ College Education