This is all very true and really, its not all that complicated. Cut out the nonsense and wasteful spending for 10-20 years and you will be in great shape.

Some of you may wonder, how exactly can I become a millionaire?

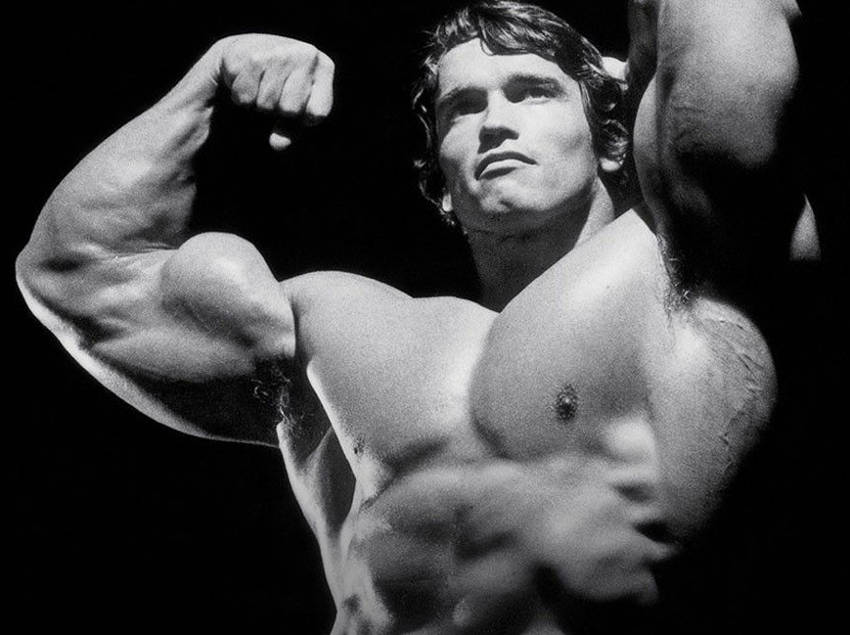

One route is to have a fabulous income. Rock stars, movie stars, or famous athletes may have no trouble achieving this status the first time they get their paychecks. Those that fall into this category achieved their success through a combination of luck, raw talent, and perseverance.

Another route is to become a successful entrepreneur. Many people became millionaires this way. However, the failure rate is very high. According to Bloomberg, 8 out of 10 entrepreneurs who start businesses fail within the first 18 months.

Others achieved the status through less than stellar means:

- Marrying into money

- Inheriting money, if they’re lucky enough to have wealthy parents

- Defying the odds by winning the lottery jackpot

- Becoming an ambulance chasing lawyer in America (see related post)

- Stealing taxpayer’s money by becoming a politician in the Philippines

For the rest of us, becoming a millionaire while keeping your day job seems like a fantasy. But nothing could be further from the truth.

Thanks to inflation, being a millionaire is now easier than ever. It is definitely achievable if you follow these steps:

Make yourself marketable

You need to have a good education to become marketable. Formal education is a must but not to the extent that you end up drowning in debt. You don’t want to be that person with $150K of student loans just to get an English degree from a private institution.

My wife and I went to less prestigious schools in the Philippines. We can both attest that all our present and previous employers care about is that you’re doing your job and that you’re doing it right.

Good name schools and high GPAs only matter when competition is tough, and you’re fresh from college. Once you’ve acquired experience, prospective employers will be looking at your skill set and track record. I know because I myself conducted many technical interviews of potential hires for my company. It’s very important to keep learning and get your skills up-to-date.

Establish a very strong work ethic

Having worked with people that came from Ivy League schools, many of them are smarter than me where I work.

But it is I who established a reputation for being a hard worker as my bosses often see me burn the midnight oil. It is I who is willing to work during weekends without being asked.

Over time, my employer became so dependent on me that I always get significant raises and bonuses. Over the span of 5 years, my salary doubled from $55K to $110K a year. I even had a bonus as large as $30K, which is unusual for a regular rank and file employee like me.

Live below your means

My wife and I didn’t spend a dime when we got married. It’s more like $400 dollars, and that includes the registration and cost of the reception. Our only other guest, besides the officiating minister, was his wife.

But we did have the money. We had over $50,000 in cash saved at the time. Instead, we chose to use it as a down payment for a house a year later.

When picking a house, we made sure that either of our incomes can afford it so that there’s a cushion in case one of us suffers a job loss. As a result, our house payment, including property taxes, is less than a quarter of our net income. In contrast, your local realtor will probably tell you that you can afford roughly twice or thrice your household gross income.

We avoided getting into debt or using a line of credit when doing home renovations. I managed to do most of the work myself saving us thousands of dollars in the process. I knew nothing about home repairs and improvements initially but was able to equip myself with the necessary skills and knowledge through reading and watching YouTube videos.

We brown bagged our lunches and drove modest cars. We spent substantially less than we earn.

Save aggressively, invest wisely

While your income is your most powerful wealth-building tool, saving aggressively is not enough. You should make your money work for you (and not the other way around) by investing wisely. When my wife and I receive salary raises, we didn’t change our lifestyle. Instead, we invested the difference.

- Maintained three to six months’ worth of living expenses for emergencies

- Contributed 20% of our salaries to tax-advantaged retirement accounts.

- Made substantial contributions to our kids’ college fund.

- The rest ends up in my brokerage account as “play money” for buying stocks.

Invest the bulk of your savings in low-cost and highly diversified stock mutual funds. Over time, you’ll be heavily invested in the market. So it is important that you STAY THE COURSE. Stocks can provide the long-term growth— but only if you’re invested.

That, folks, is how regular people like you and me become millionaires.