How to Make Your Grandkids Millionaires With as Little as $1,000

- By : Menard

- Category : Relationships

- Tags: Asset Allocation, Legacy

We all love our grandkids, sometimes even more than our own kids. Admittedly, there are moments when I wish my teens would leave the nest yesterday, especially when they test our patience. But new grandkids? They’re the cutest, most innocent little beings, untouched by the influences of social media and pesky teenage peers.

We don’t have a grandkid yet, but my siblings do. We haven’t met them since they all live far away, but they’ve been popping up on my social media feed like mongo beans sprouting overnight.

But what if I told you that with as little as $1,000, you could set them on the path to becoming tax-free millionaires? Especially when you start when they are babies!

So, let’s dive into the steps to make this dream a reality and set our little ones on the path to prosperity.

Step 1: Open a 529 investment account

I know what you’re thinking: 529 plans are supposedly for college. There’s no guarantee that they’ll make your grandkids millionaires. But here’s the strategic twist—starting in 2024, the Secure Act 2.0 allows 529 plans to be rolled into a beneficiary’s Roth IRA, up to $35,000, subject to the same rules as regular IRA contributions.

Sure, you want them to attend college, but that’s not the grandparent’s responsibility. Let the parents save for that goal. Instead, let’s focus on making your grandkid a millionaire—a much longer-term but equally noble goal, regardless of whether they finish college or not.

The key is to open an investing account rather than a guaranteed savings plan, which is a less effective way to save money. We want to invest in stocks for maximum growth, not just in investments that merely keep up with inflation. At the minimum, you’ll need to ask their parents for their social security numbers.

Step 2: Invest $1,000 in Total Stock Market fund (stay the course for 15 years or more)

You can contribute as much as you like. But with no additional contributions, $1,000 should grow to almost five times as much as the original principal:

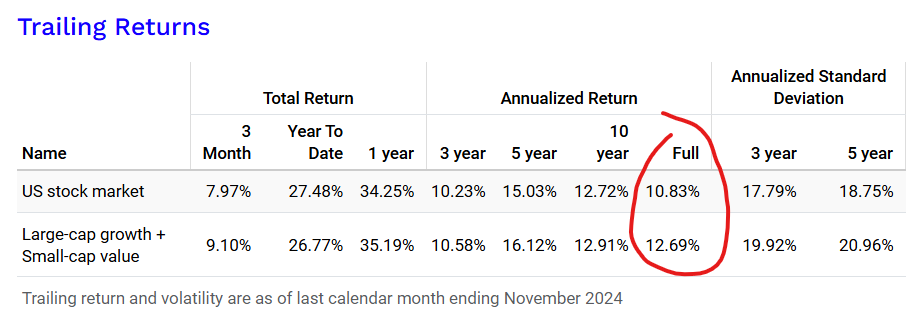

Historically, the stock market returned an average of 10.83% since 1972. Assuming the same rate, $1,000 would have grown to $4,675.84 by the time your grandkid starts working at your local retail store.

But, why wait 15 years? As per IRS rules, the 529 account needs to be opened for 15 years before you can roll it to your beneficiary’s Roth IRA account.

Step 3: Roll the money into your grandkid’s Roth IRA account

Fast-forward 15+ years to when your grandkid starts their first job. Invite your son or daughter (i.e., the parent) and your grandkid over for dinner. Ask them to open a custodial Roth IRA and offer to fund it with the first $4,675.84 (yes, that exact number so you’ll show this post, lol). Or better yet, tell them you’ll match every dollar your grandkid saves up to that amount (subject to IRS contribution limit) to get them invested in their own future.

With a Roth IRA, you can contribute up to the IRS limit set for that year (hopefully much higher than the current $7,000 limit due to inflation) or the child’s earned income for that year, whichever is lower. This way, any money invested grows tax-free! Plus, unlike a 529 account, you can invest in almost any fund under the sun.

Of course, this assumes your grandkid hasn’t sprouted a horn and you still care about them. Otherwise, feel free to skip Step 4: just make a non-qualified distribution from the 529, absorb the 10% penalty and taxes on the gains (you’ll still come up ahead), and treat yourself to something nice instead. Maybe a trip to Europe? Lmao.

Step 4: Split between large-cap growth and small-cap value stocks

Now that the money is in the right vehicle, it’s time to invest in the following funds:

Large-cap growth stocks are typically well-established companies with a strong market presence (Apple, Microsoft, Alphabet, etc). They offer stability and steady growth potential, making them a reliable choice for long-term investments. These companies often have a history of consistent earnings and are less likely to face significant financial difficulties.

Small-cap value stocks, on the other hand, are companies that are considered undervalued by the market. They have the potential for significant growth as they are often in the early stages of development or undergoing a turnaround.

Using the PortfolioVisualizer, I’ve backtested this portfolio against the performance of the US stock market as a whole based on 50+ years of historical data (starting January 1st, 1972) and the result is quite impressive. Together they’ve outperformed the latter by almost 200 basis points.

Step 5: Let the money compound for 50+ years

As the global population grows and the American economy thrives, great companies in the U.S. will continue to expand, innovate, and prosper. By staying the course, regardless of short-term market fluctuations (hint: the stock market always trends upward in the long term), your grandkid’s account will benefit from the power of compounding over the span of five decades.

Of course, it’s crucial that your grandkid understands this principle, so make sure they’re educated about the importance of staying invested even when the market is down.

Here’s how the account should have grown over this period:

If history is any indication, your initial $1,000 investment grows to over $1.8 million, tax-free, without any additional contributions. Just imagine how much more impressive this legacy could become with regular contributions (scroll up, and play with the numbers)!

Even if you’re not around to see it, your grandkid will be kissing your grave and thanking you for setting them up for life. Talk about leaving a lasting legacy!

No Comments