Welcome to my Calculators section! Here you will find tools you might find helpful in your journey to becoming a millionaire, or even better, financially independent!

If you have a website and want me to build something similar for you, feel free to contact me.

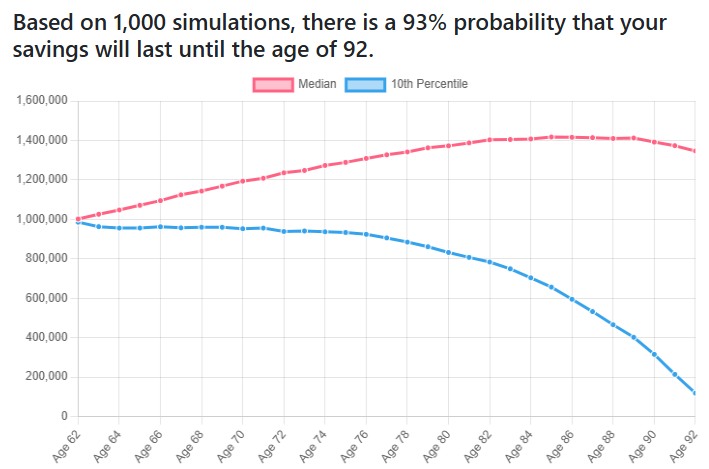

Monte Carlo Retirement Simulator

Scared that you might not be able to retire? Fear not! This not-so-simple calculator performs 1,000 simulations to give you valuable insight into the longevity of your savings.

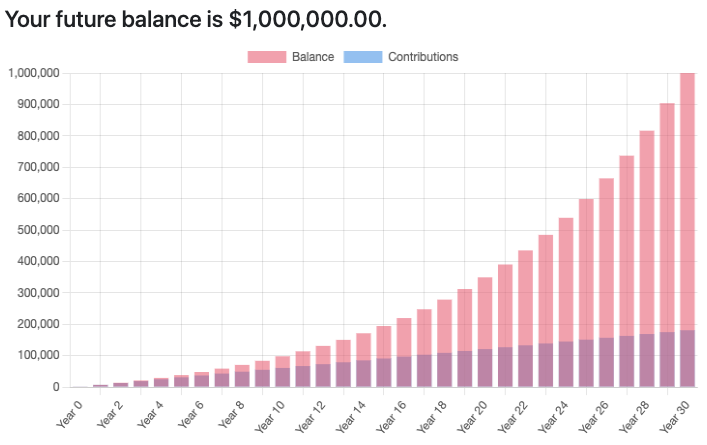

Compound Interest Calculator

Consistent investing over a long period can be an effective strategy to accumulate wealth. Even small deposits to a savings account can add up over time. This calculator demonstrates how to put this savings strategy to work.

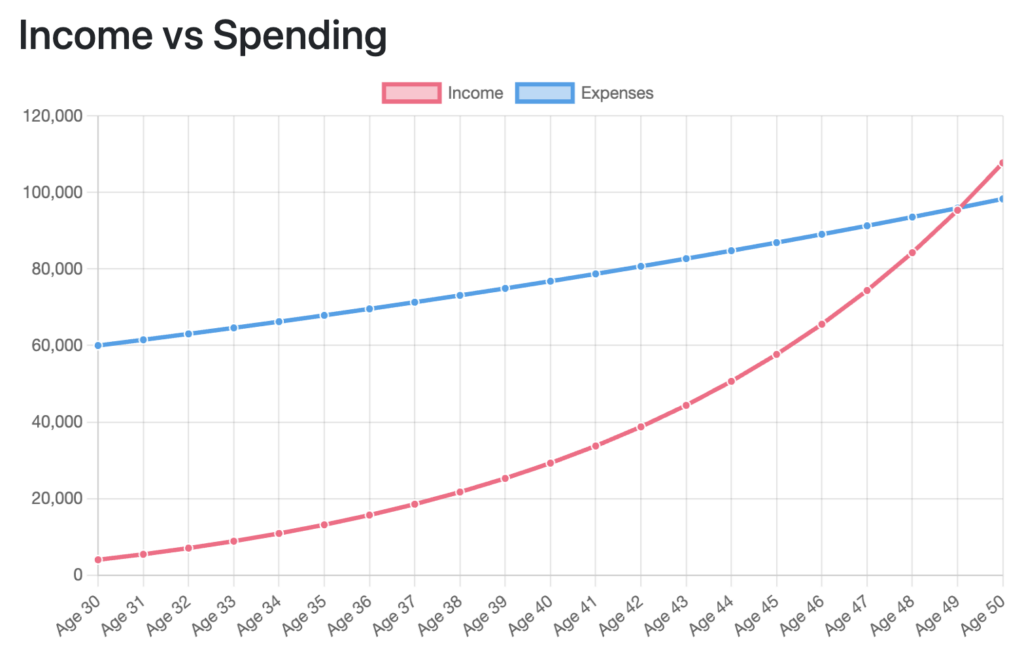

Financial Independence Calculator

A simple calculator that tells you when you can retire based on the 4% rule. In a nutshell, you can safely quit once you’ve saved 25 times your annual expenses in retirement. This assumption is based on a 30-year retirement.

Millionaire Next Door Calculator

In his book, The Millionaire Next Door (published 1996), best-selling author, Dr. Thomas J. Stanley, wrote about a formula you can use to calculate your expected net worth:

“Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be.”

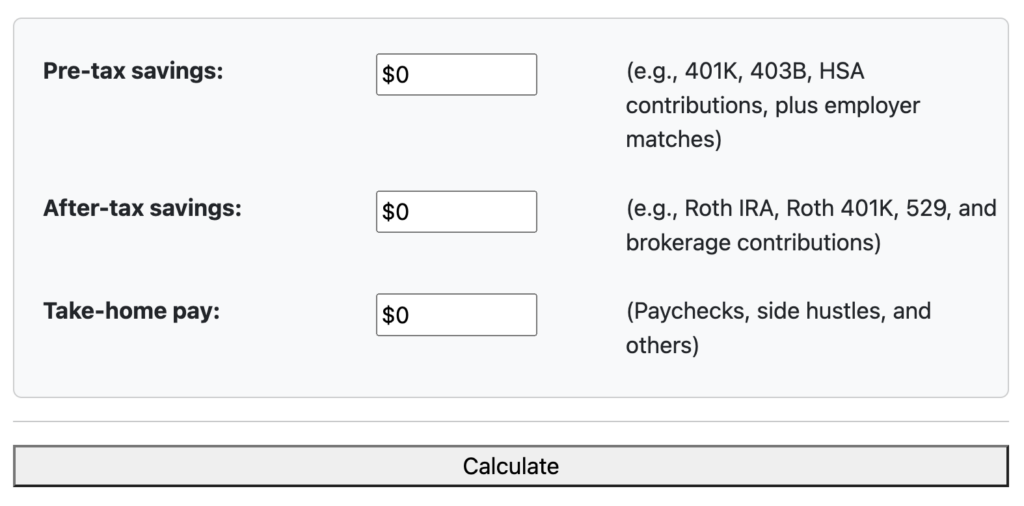

Savings Rate Calculator

Along with your net worth and spending, your savings rate is one of the most valuable tools you can use to track your progress. It’s particularly handy in predicting how long it will take you to become financially independent.

Assuming an 8% return on investment, If you save 50% of your income, you’d be able to retire in less than 15 years. Save only 10%, and you’ll be working for 50+ years— the rest of your life!

Recent Posts

Recent Comments

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on From Diapers to Diplomas: Tips on How to Fully Fund College Using 529s

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

- on Why I’m Saving More in a Taxable Brokerage Account, Maybe You Should Too

Categories

- About me3

- American dream10

- Asset allocation1

- Blogging4

- Books8

- Budgeting2

- Career6

- Credit4

- Financial Planning25

- Fitness1

- Fraud2

- Giving1

- Guest Post2

- Happiness3

- Health2

- Income2

- Insurance4

- Investing31

- Lifestyle21

- Motivation7

- Relationships20

- Retirement16

- Romance2

- Saving for college5

- Saving ideas11

- Side Hustle3

- Speculation4

- Spending11

- Taxes3

- Vacation3