Net Worth Update: Eight Years Later

- By : Menard

- Category : Financial Planning

- Tags: Net worth

I’m supposed to share our household net worth every Labor Day. It’s a tradition I’ve observed since I started this blog. Unfortunately, I got sick after my long flight from Manila. But it’s better late than never.

This year, I’m going to do something different: I’m sharing actual investments!

Ladies and gentlemen, without further ado:

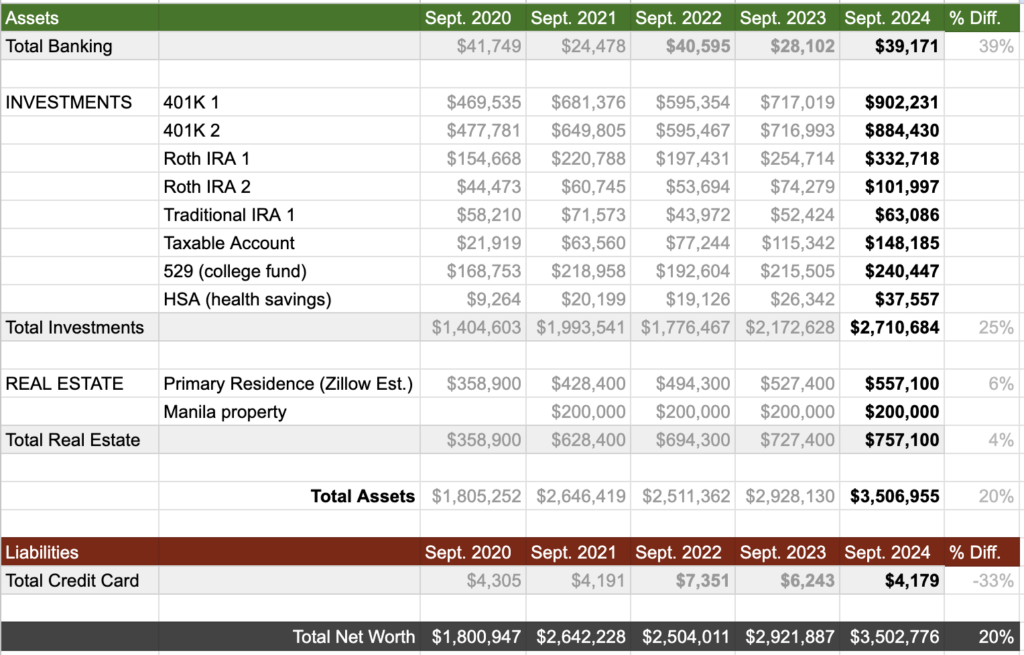

Investments are up by 25%

As of this writing, we have roughly $2.7 million liquid investments spread out in eight accounts. Not counting the college fund, we already passed our $2.5 million target retirement number including emergency reserves. Thanks to a very strong 2024 bull market.

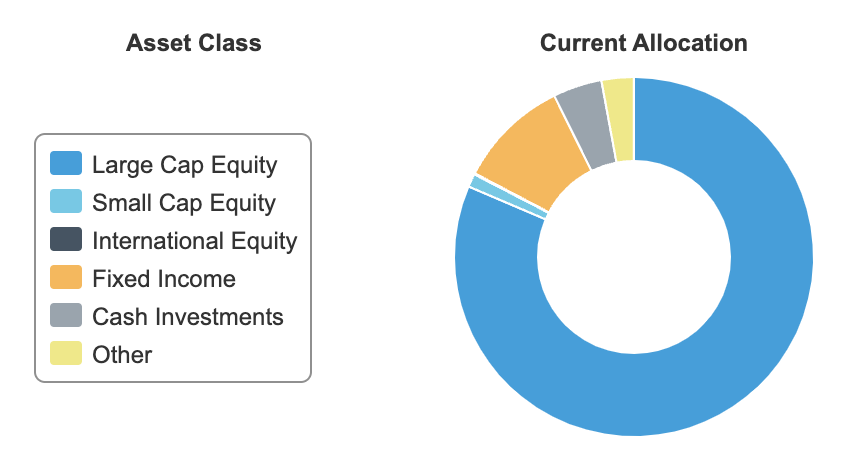

As you can see below, we’re heavily invested in the S&P 500 and the technology companies tracked by the index (MSFT, AAPL, etc.). Even funds that track the whole market like VTI/VTSAX have become tech-heavy in past few decades. Hence, I don’t mind any overlap.

Asset allocation:

Besides, technology is the only sector that every other sector heavily depends on in order to thrive. Think about payment technologies, big data, cloud computing, and artificial intelligence, to name a few. The S&P 500 is tech-heavy for a reason.

An alternative is to invest in an equally weighted fund like Invesco S&P 500® Equal Weight ETF or RSP, which is more diversified but underperformed Vanguard’s VOO in the last 5 years.

I’ve sold all our small caps in favor of bonds and cash as part of my de-risking strategy before retirement. Sure, the Russell 2000 index, which tracks small companies, are expected to rise even faster as the Fed lowers rates, but it’s not the risk I’m willing to take a year or two before retirement.

We no longer own international funds either; these mega caps are heavily invested globally anyway.

Maybe we should get rid of the credit cards

Dave Ramsey is dead right when he said nobody got ever rich from credit card points. As one becomes richer and older, it becomes apparent it’s not worth your brain power to keep track of 4 or 5 credit cards. That way, I don’t have to list them as liabilities in our net worth statement.

However, getting rid of one of the cards cost me my shredder recently. It turns out the new ones are made of metal! They simply can’t be discarded using the machine, ugh!

It’s important to note that we’ve never paid interest on any of our credit cards. We ensure the statement balance is paid in full automatically every month. This is a crucial habit for anyone aspiring to become a millionaire.

Net worth statement for 2024

(i.e., Total assets minus total liabilities )

Other assets not listed

Our net worth statement doesn’t include the following:

Automobiles and other personal property (< $40K): I drive a 12-year-old Toyota Prius C with over 200,000 miles. My wife drives a new Toyota Corolla Hybrid. We kept the 16-year-old Honda Pilot for family trips. They don’t amount to much.

My wife’s company pension: She will receive roughly $1,900 per month for life when she retires at 55. I won’t include it in this report because her company doesn’t allow lump sum payments.

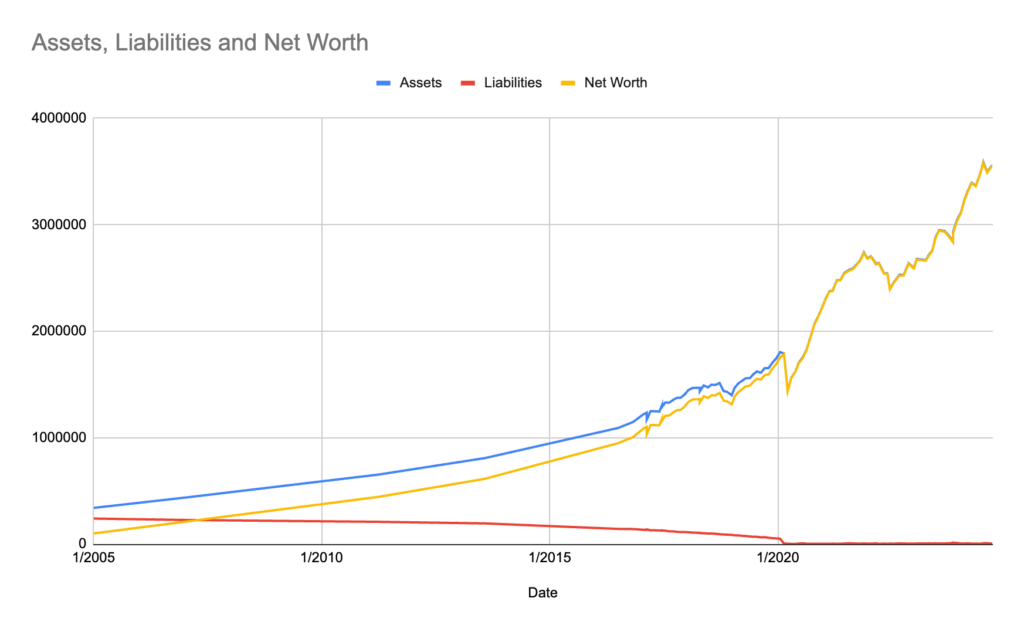

Historical net worth

Major milestones of our financial journey

- Apr/2004 – Got married (doubled our household income)

- Jan/2005 – Bought our first house, $200K in net worth

- Nov/2016 – $1,000,000 in net worth (the first million is the hardest)

- Feb/2020 – Paid off house right before the pandemic

- Oct/2020 – $2 million in net worth (4 years from first)

- Dec/2023 – $3 million in net worth (3 years from second despite a bad 2022 market)

Upcoming milestone:

- July/2026 – Retire at 55 with the 4th million! ($3 million in retirement funds, let’s cross our fingers)

All in all, net worth is up by 20%

Thank you for taking the time to read about our financial journey. I’m enthusiastic about the future and the opportunities for growth ahead. Wishing you all the best in achieving your own net worth goals!

Let’s remember that money is merely a tool, not the ultimate goal. Personally, I want my wife to leave her stressful RN job and for my boss to stop bothering me. It’s about having the freedom to pursue our own goals, not those of our bosses.

See also: The Road to Riches Starts Here: Track Your Net Wor

No Comments