Net Worth Update: Two Years Later

- By : Menard

- Category : Financial Planning

- Tags: Net worth

One reason why I share my net worth over Labor Day Weekend is that of something with symbolic importance. The holiday is meant to celebrate the achievements of American workers. To quote the U.S. Department of Labor, “a tribute to the contributions of workers have made to the strength, prosperity, and well-being of the country”. You can replace “country” with the word “employer” if need be.

The other reason is that the holiday break will give me extra time to sit down and actually write the report. I’ve seen other personal finance bloggers do this every quarter, while others do it on a monthly basis. I decided to do this report on a yearly basis only because I’m already tracking my monthly progress on NetWorthShare, which is slightly higher because it includes other assets like vehicles and other personal property.

Total assets up by 13%

Our banking assets are up by 30% from last year. The largest of these– the emergency fund sits in a money market account earning 1.85% annual yield with no check-writing ability. That way, we won’t be tempted to use it for everyday expenses. The rest is in savings and checking accounts earning little to no interest. With stock market prices close to an all-time high, I figured we needed to save more cash until we find a more attractive investment. I’ve been seriously contemplating investing in tangible rental property in the not so distant future.

Retirement investments and other savings are up by a very healthy 19% due to contributions and strong US stock market returns. This is in spite of the fact that we are putting in at a slightly lower rate into our 401Ks in favor of paying off our mortgage. That said, I’m not that delusional to think that the market will rise forever. It’s inevitable that a correction will take place, it’s just a matter of time. Hence, I’m piling more cash than usual.

The additional Microsoft shares (MSFT) that I bought more than a year ago inside a ROTH IRA account have almost doubled in value. I’ve been holding this stock since 2003, my only regret is not buying more. My other individual stock, Bank of America (BAC), has stalled in the 28-32 price range since January. I’m not selling either of these two anytime soon.

Not sure how accurate Zillow valuation is, but our home took a -4% hit compared to last year. My guess is that last year’s valuation was a bit higher than it should be. It’s currently a seller’s market so I was expecting it to go up. That said, I don’t really consider my house as an investment– it’s just a place to live.

Liabilities down by 20%

As I’ve already mentioned, we are aggressively paying down our ultra-low-interest mortgage by shelling out an extra $1,000 towards the principal– something that many mortgage-debt-hugging finance nerds will cringe about. Like I said before, it’s not about chasing returns. It’s a way to simplify my life and diversify away from the stock market. The goal is to be able to retire with a paid-off house. That way, we have lower income taxes when we retire because we are drawing fewer funds from pre-tax retirement accounts. Not to mention stronger cash flow when the kids are in college.

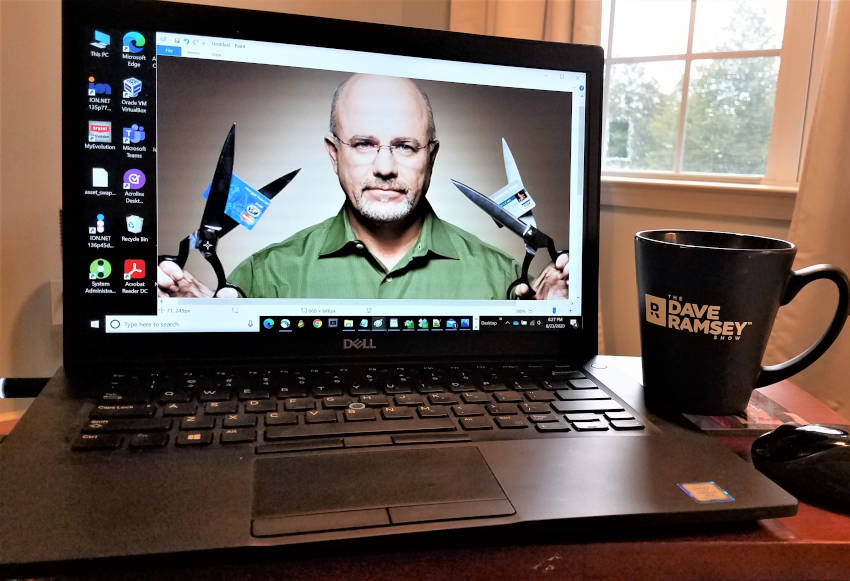

Credit card debt increased by 30% due to a recent purchase of airline tickets (We’re flying to Houston in a few hours). No worries about that as I am paying them all in full as the bills arrive. I hate debt, but not bad enough to perform “plastic surgery” as Dave Ramsey urges you to do. That’s something that you should do if your spending is out of control. But for me, I apply the credit card rewards that I earn as statement credits, so I’m actually using them as a tool to save extra money.

All in all, net worth is up by 16%

We fell a little short of our goal of achieving a 20% growth rate, but we’re very happy nevertheless. For one thing, we finally can designate ourselves as an SEC accredited investor. That in itself will offer a lot of investment opportunities.

As I’ve always been saying, there’s nothing sophisticated about our investment portfolio. The strategy is very simple– invest in stock mutual funds inside tax-advantaged retirement accounts.

I hope you’re also doing well in your journey. We hope to be an inspiration to other people on a similar path to financial freedom.

No Comments