Great points you raised there. I think religion may be the worst reason to send your kids to expensive schools. In any case, I dream of the day when the quality of teaching in Philippine public schools (especially in grade and high schools) improves to the extent that we won’t be afraid of sending our kids there.

Stupid Money Mistakes my Smart Neighbors Make (Part I: Private Schools)

- By : Menard

- Category : Relationships, Saving for college

- Tags: money mistakes, private schools, stupid mistakes

One of my goals in writing this blog is to help you become smarter with money. You’d think it’s just common sense. But as it turns out, common sense is not so common. Otherwise, people wouldn’t buy things they can’t afford. They wouldn’t smoke cigarettes or eat junk food either.

To become smart involves a lot of learning. We read authoritative articles over the web, or maybe books written by experts, for example. But in many cases, we learn from our own mistakes. After all, your experience is the best teacher, right?

Not really, it’s actually better to learn from the mistakes of others–myself and my neighbors included. You don’t want to overdose with heroin to learn that the drug can kill you– it will be too late at that point. Learning the hard way is completely optional.

Of course, this is not to make fun of my neighbors. Everyone makes mistakes. It’s the act that’s stupid not necessarily the people making it. I’ve blogged about my own dumb mistakes before. But this series is about the dumb mistakes my neighbors made or are still making. I’ve masked their true identities to protect the innocent, but the details are factual.

“Learn from the mistakes of others. You can’t live long enough to make them all yourself.” – Eleanor Roosevelt

Paying for private school for the sake of religion

A few of my neighbors are also Filipino-Americans. Like me, they were raised as Catholics. I’ve given up Catholicism years ago, but I’ve stayed very close to my neighbors who happen to be my friends. They belong to a closely-knit Catholic community headed by a parish priest who is widely respected and revered. My neighbors were strongly encouraged to enroll their children in the parish school where education is interwoven with their faith and traditions.

Because of their religious beliefs, they all sent their kids to the local Catholic school that can cost up to $5,000 per child. That’s $400 per month that they could have contributed to a tax-advantaged college savings account. Had they, from the very beginning, invested that money aggressively in 529 accounts, they would have enough money to pay for their kids’ college education.

I actually suggested the idea when we had a gathering over a decade ago, but it was quickly dismissed with a smirk. Now some of them are scrambling to find loans and potential scholarships when they should have prepared for this a decade ago.

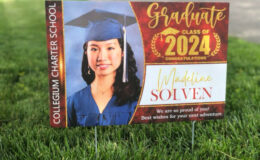

Where I live, public education, especially its popular alternative– charter schools, is decent and completely free. Well, sort of, as homeowners, we pay substantial property taxes and a huge percentage of these taxes are allocated to fund public schools. So we might as well take advantage of the services that we’re actually paying for anyway.

Don’t get me wrong. Sending your kids to private schools per se is not dumb. Sending them when you haven’t saved for their college education is. Paying for private schools when you haven’t paid off your own student loan debt is even dumber.

I can understand the parents desire to instill the same religious values to their children. But providing a “bubble” like atmosphere is not the way to go. Someday their kids will leave this bubble and interact with various types of people. They need to prepare their kids for the real world.

And by the way, the local priest has been charged for raping a girl and recording their sex acts.

Letting their kids decide where to attend college

At a recent gathering, I had a conversation with a neighbor friend of mine who I haven’t seen in weeks. It turns out that he and his wife have been busy driving their daughter out-of-state to college open-houses to know more about the schools she’s interested in applying to.

“Elaina just got a $15,000 scholarship at Georgetown University, renewable for four consecutive years!” he exclaimed.

“That’s awesome! What major does she intend to take?” I replied.

“Bachelor of Science in Nursing” he answered back.

“Are you paying for the rest?” I replied knowing that Georgetown University is one of the most expensive universities in America. There’s no way $15K can cover the entire tuition amount.

“No way, she’s the one who wants to go there. She’ll figure out a way to pay it off,” he replied as if there’s nothing he can do about it.

Immediately, I felt sorry for 18-year-old Elaina. Even with a $15,000 scholarship, the annual total cost could easily reach $50,000 if you include on-campus room and board, and other expenses. That’s a $200,000 investment if you’re lucky to finish the course in four years.

Is the $200,000 private education worth it? Absolutely not, my wife is a BSN and she knows for a fact that employers don’t really care where you completed your degree, let alone how much you spent for it. You can obtain that degree for a small fraction of that– around $10,000 per year in a nearby university, much less with scholarship and grants. And she doesn’t even have to pay for room and board as it is completely within driving distance.

No parental intervention

That’s a $200,000 decision, why on earth would they as parents decide to not intervene?? In general, 18-year-old kids are naive and inexperienced. They have no inkling of what it takes to pay off a $200,000 student loan debt. They can easily be enamored by the nice facilities offered by these overpriced American educational institutions.

The problem is the enormous amount of risk an innocent 18-year old will have to assume to obtain this education. Unlike credit card debt, student loans are not in any way dischargeable by filing bankruptcy. It follows you like a monkey on your shoulder.

The worst that can happen is she gets sidetracked by some unexpected event like a debilitating injury rendering her unable to work. Or she can end up eloping with her boyfriend before completing her studies.

Not probable if she’s focused, but still possible. There’s no shortage of possibilities, the parent should have intervened!

When my eldest son applied to different colleges several years ago, I accidentally opened a letter that was addressed to him (he’s my junior– we have the same first name). It was a letter of acceptance from a prestigious private school that costs about $40,000 a year. At the time, he was already set to go to an excellent in-state public university that costs less than half as much. That letter went straight to the trash can.

I’ve kept it a secret all these years and have no regrets whatsoever. You can call me controlling, but at least I’ve intervened. I’m the one paying, not him. Besides, that public education didn’t stop him from getting hired at IBM.

By the way, he’s only 25 and already debt free. Unlike the millions of Americans who are struggling to pay student loan debt today.

In part II, we’ll talk about my neighbor’s stupid car payments.