Suze Orman Could be Right, This Calculator Can Tell You Why

- By : Menard

- Category : Financial Planning, Retirement

- Tags: FI Calculator, Suze Orman

If you’ve been following my posts, you probably know by now that this is not a FIRE (Financially Independent, Retire Early) blog. For one thing, I’m already in my forties when I wrote my first post. There’s no way I could retire in my 30’s without sneaking into my sister’s time machine. I seek Financial Independence as early as possible but closer to the traditional “early retirement” age of 55 to 60.

But just the same, I sort of freaked out when I listened to Suze Orman’s interview on Paula Pant’s Afford Anything podcast where Orman basically threw a bucket of water to aspiring FIRE practitioners. The movement led by millennials has been growing by leap and bounds on the internet.

When asked if she has heard of the FIRE movement, Orman replied, saying “I hate it. I hate it. I hate it. I hate it. And let me tell you why.”

“Not only do things happen when you’re older, but things happen when you are younger. You get hit by a car. You fall down on the ice, You get sick. You get cancer,” she said. “If a catastrophe happens, if something goes wrong, what are you going to do? You are going to burn up alive.”

She then suggested that you need at least $5,000,000, to retire early. Maybe $10,000,000 or $20,000,000, depending on your expenses.

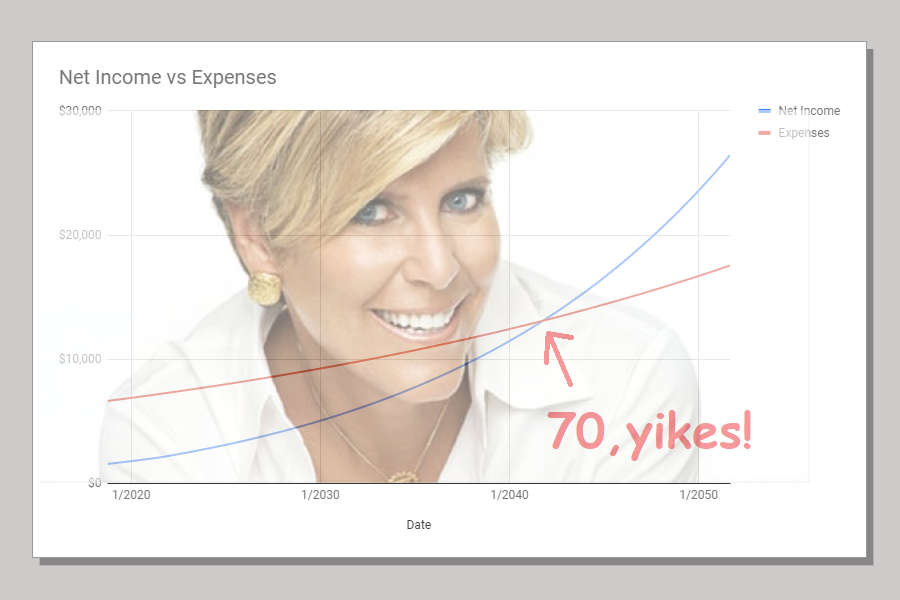

Introducing the new MB50 Suze Orman Financial Independence Calculator

Rather than continue whining over the internet to tell people that Suze is out of touch with reality, I decided to swallow my pride, start from scratch, and create a new version of my Financial Independence calculator. That way, we’ll both know who’s telling the truth. Does Suze Orman actually has a point or was she just fear mongering?

This new calculator offers advanced features, among them:

- Itemized monthly average expenses

- Mortgage pay off date if applicable

- “Hit by a bus” date, just in case the unthinkable happens

- Crossover Point chart that tells you precisely when you will become F.I.

Of course, the calculator has to work from some assumptions:

- You stop making contributions to your retirement assets after achieving F.I.

- You can’t depend on Social Security and Medicare

- Your supposed mortgage payment gets invested in your retirement account once it’s completely paid off

- Expenses and contributions are indexed to inflation

- Expenses double when you get “hit by a bus”, like when you’re suddenly gets diagnosed with cancer

The following are examples…

Optimistic Scenario

Joe, a single-guy can finally retire on 12/2031 after religiously contributing $2,000 monthly. His expenses are minimal as he’s mostly on Dave Ramsey’s “rice and beans” diet. At an average long-term rate of 12%, with dividends re-invested, he ends up with $961,110 in his retirement account after being in the workforce for only 14 years. He’s FIRED at 35!!!

Orman Scenario 1 (Market crashes, Low Investment Yields)

This is the same Joe except that the market didn’t return as much as he initially expected, growing at an average return of only 6%. His investment yield is also cut in half to 2%. As a result, he can’t retire earlier than he anticipated. He still is able to retire early, but at 53, it’s closer to the traditional early retirement age.

It helped that his expenses are low. He ends up with $3,283,493 in his retirement account after being in the workforce for 32 years. He’s FIRED at 53– not too impressive, but at least he has three times as much before inflation (If he’s wise, he should wait until he’s 55 to take advantage of IRS Rule of 55).

Orman Scenario 2 (Major Catastrophy)

The market performed better, so Joe’s retirement assets grew at an average return of 8%. This modest growth coupled with his frugal lifestyle enabled him to retire at 45 after spending only 24 years in the workforce.

However, unbeknownst to him, a cancer tumor was already growing the day he resigned. One year later, he was diagnosed with a rare form of cancer. Fortunately, he has health insurance. But still, his expenses suddenly doubled.

It didn’t help that the overheated economy due to the rise of Artificial Intelligence had increased inflation and doubled the tax rate (laughable, but that’s directly from Suze). Insurance covered some, but not all of his expenses. In short, Joe is in deep sh*t.

Here’s a link to the spreadsheet. There’s also a “wild west” public version that’s completely editable without a Google account.

I’d love to hear your feedback.

No Comments