Traditional vs Roth 401K: Understanding How They are Different

- By : RPendykoski

- Category : Retirement

- Tags: ROTH 401K, Taxes, Traditional 401K

One of the not-so-easy decisions many American workers face today is choosing the right type of 401K to contribute to so they can minimize as much taxes as possible. Luckily, we have an expert that can chime in for you.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning firm based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last 10 years has turned his focus to self-directed accounts and alternative investments. Rick regularly posts helpful tips and articles on his blog at SD Retirement as well as Business.com, SAP, MoneyForLunch, BiggerPockets, SocialMediaToday, and NuWireInvestor.

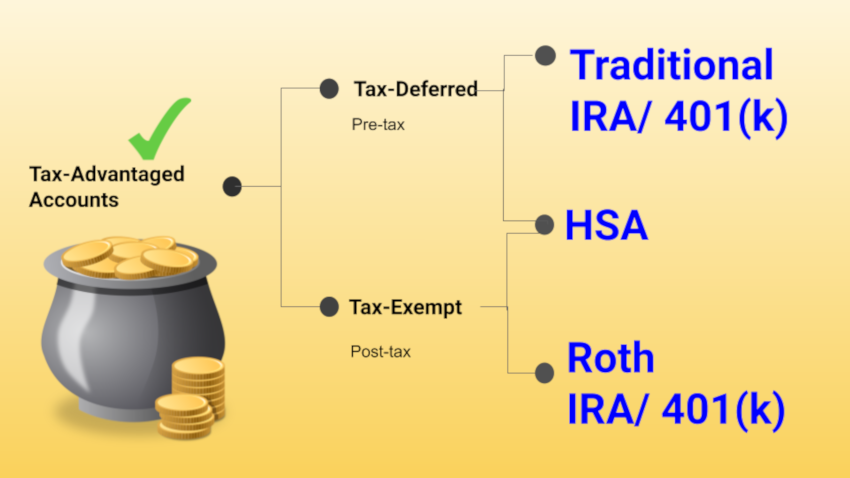

One thing that can significantly affect your long-term and retirement savings is the type of employer-sponsored retirement plan you choose. While traditional 401(k) plans and Roth 401(k) sound similar, there are some major differences between the two accounts.

It is important to understand the difference between the two so that you can select the one best for you.

Traditional 401(k)

This is a tax-deferred method to pay for retirement. All your retirement contributions and matching funds from the employer will go into your account before the taxes. This reduces your tax bill by lowering the taxable income.

You won’t have to pay taxes until you start making withdrawals. The withdrawals can be done by the age of 59½, all of which will be penalty-free. You must start taking minimum distributions from a traditional 401(k) by the 1st of April of the year after you turn 70½, or if later, the year in which you retire.

Roth 401(k)

A Roth 401(k) has the opposite tax setup than that of traditional 401(k). You will use after-tax money to fund the contribution. However, your contributions and the earnings grow tax-free, provided you don’t withdraw the funds before the age of 59½.

There are no income limits, therefore, you can make Roth 401(k) contributions no matter how much you earn, as long as you earn a salary. Secondly, you need to start taking the minimum distributions the year after you turn 70½.

Regardless of whether you are contributing to a traditional 401(k) or Roth 401(k), the total IRS 401(k) contribution limits are $18,500 a year if you are under 50 and $24,500 a year if you over the age of 50.

Traditional 401(k) vs Roth 401(k)

Let us understand the differences between traditional 401(k) and Roth 401(k)

| Traditional 401(k) | Roth 401(k) | |

|---|---|---|

| Tax for contributions | All the contributions are made pre-tax. This reduces your current adjusted gross income. | The contributions are made after taxes and there is no effect on the adjusted gross income. The employer matching funds go into a pre-tax account and are taxed when distributed. |

| Tax at Withdrawals | All the distributions in retirement are taxed as ordinary income. | There are no taxes on qualified distributions in retirement. |

| Withdrawal Rules | The withdrawals of contributions and earnings are taxed. You will be penalized if the distributions are taken before the age of 59½, unless you meet one of the IRS exceptions. | The withdrawals of earnings and contributions are not taxed as long as the distribution is considered qualified by the IRS, namely: a) The account has been held for five years or more b) The distribution is due to a death or disability or on/after the age of 59½. Unlike Roth IRA, you cannot withdraw contributions at any time. |

Choosing Between Traditional 401(k) and Roth 401(k)

The decision of choosing between Roth 401(k) and traditional 401(k) boils down to how you want to put the money into the account. Additionally, it also depends on how you want to withdraw the money.

When to choose Traditional 401(k): If your primary goal is to reduce the taxable income now or pay the taxes after retirement because you believe that the tax rate will go down.

When to choose Roth 401(k): If you prefer paying the taxes now or believe that the tax rate will be higher in retirement than what it is now. By paying taxes now, you would be protecting yourself from a potential increase in tax rates when you retire. However, there is a chance that your taxable income may drop and put you in a lower tax bracket.

In Conclusion

Once you understand the difference between Roth 401k vs 401k, you can decide which 401(k) account will give you better returns. Consider your retirement goals and current financial situation as well to reach an informed decision.

No Comments